Decoding Wall Street's Impact on US Housing Market Trends

- Authors

- Published on

- Published on

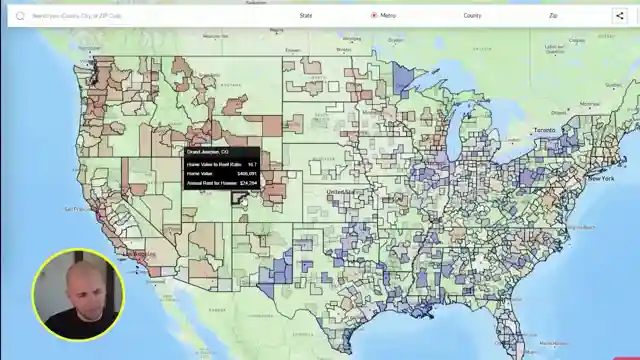

In this episode of Reventure Consulting, we dive headfirst into the tumultuous world of Wall Street traders and their risky bets on the US housing market. They're shouting from the rooftops that the market is a whopping 35% overvalued, signaling stormy weather ahead for potential home buyers. The colossal Invitation Homes, with a staggering 85,000 properties under its belt, is feeling the heat as its stock takes a nosedive by 20% in just four months, trading at a jaw-dropping 35% discount to its net asset value. It's like watching a high-stakes poker game where the chips are the very roofs over our heads.

Meanwhile, the American dream of owning a home is becoming a distant reality for many as prices soar to dizzying heights, with the average house value in 2025 hitting a staggering $357,000. But hold onto your hats, folks, because the rollercoaster ride is far from over. The burning question on everyone's lips is whether 2025 will finally be the year when the housing market sees a much-needed correction or if the prices will continue their upward trajectory. The battleground is set, with the North witnessing price hikes while the South, including states like Texas and Florida, braces for impact as prices begin to dip.

As the dust settles, it's clear that the once-mighty Wall Street titans are facing a reckoning. Companies like Invitation Homes and American Homes for Rent are seeing their valuations plummet, sending shockwaves through the stock market. The Wall Street Journal sounds the alarm, revealing that US homes could be overpriced by a staggering 10-35%, painting a grim picture for investors. The home price to rent ratio emerges as a crucial metric, indicating that the housing market is over 20% overvalued, urging investors to tread carefully in these turbulent times.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Wall Street issues 2025 warning: home prices massively overvalued on Youtube

Viewer Reactions for Wall Street issues 2025 warning: home prices massively overvalued

Stock price of America's 2 largest landlords has tanked in the last four months

Concerns about the housing market and investors in 2025

Impact of inflation and borrowing costs on housing market projections

Calls to ban corporations and hedge funds from buying single-family homes

Success story of using data to negotiate rent

Effects of the pandemic on housing problems and foreclosures

Comments on the overvaluation of the housing market

Interest in timing the market for buying houses or redirecting focus to the equity market

Observations on the high prices and changes in the housing market in different regions

Speculation on a potential housing crisis and market conditions

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.