US Housing Market Shift: Declining Rents Impact Home Prices

- Authors

- Published on

- Published on

In a recent report by Reventure Consulting, the US housing market is facing a seismic shift, with landlords grappling with a sharp decline in rents, triggering a cascading effect on home prices. Cities like Austin, Texas, are witnessing rent drops of nearly 10%, sending shockwaves through the real estate landscape. This trend is not exclusive to Austin, with Minneapolis, Portland, Raleigh, and other major cities experiencing significant rent decreases, creating a buyer's market and forcing investors to rethink their strategies.

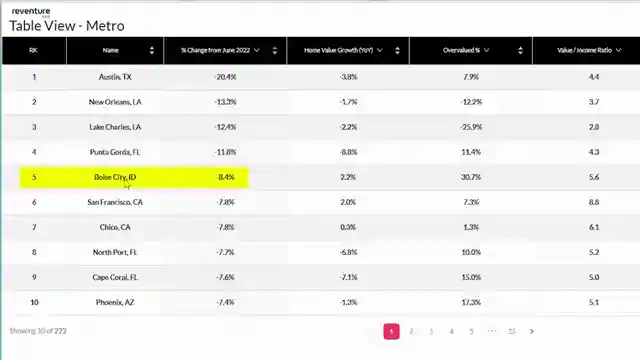

The repercussions of these declining rents are far-reaching, leading to a mass exodus of investor-owners as property taxes and insurance costs continue to rise. The housing market in Austin is particularly hard hit, with home values plummeting by 20% from their peak, signaling a substantial downturn. Other cities like New Orleans, Lake Charles, and Phoenix are also feeling the squeeze, with home prices taking a hit amidst the shifting rental landscape.

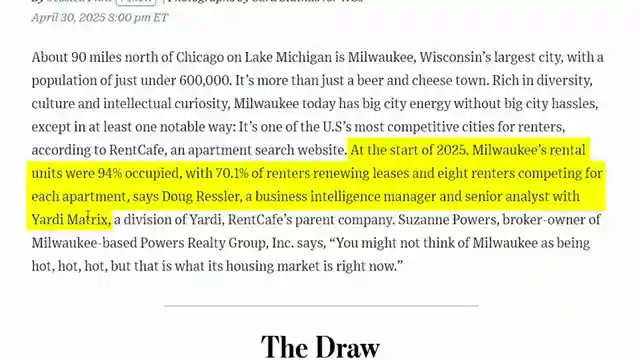

The disparity in rental trends across different regions reflects a broader reversion in migration patterns, reshaping the dynamics of affordability and investor behavior. Markets such as Denver, Phoenix, and Dallas are experiencing the most significant rent decreases, while Fresno, Providence, and Chicago see rent increases. This regional variation underscores the evolving nature of the housing market and its implications for prospective homebuyers and investors alike.

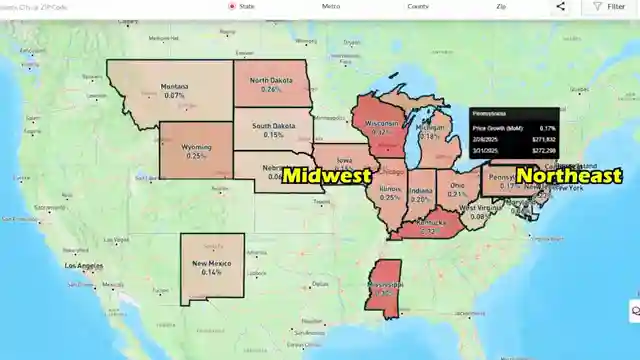

Moreover, the analysis dives into overvaluation rates across various states, highlighting the Midwest's relative stability compared to the Southeast and Mountain West regions. Cities like Dallas grapple with a 25% overvaluation, while Austin shows signs of correction at only 8% overvalued. Understanding these nuanced market dynamics is crucial for navigating the complex real estate landscape and making informed investment decisions. The study's insights shed light on undervalued markets like Manhattan and overvalued markets like Las Vegas, emphasizing the importance of local overvaluation data in guiding strategic real estate investments.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Landlords hitting the panic button. (30% rental market firesale underway) on Youtube

Viewer Reactions for Landlords hitting the panic button. (30% rental market firesale underway)

Rents are down in various cities including Austin, Minneapolis, Raleigh, San Diego, Jacksonville, Orlando, and New York

Landlords across the U.S. are being forced to sell their real estate due to rent cuts

Some viewers are expressing concern about the state of the housing market and the impact on renters and buyers

There are contrasting opinions on whether it is a good time to invest in real estate

Some areas like California are experiencing rent increases rather than decreases

Specific mentions of high rental prices in certain areas such as Savannah and California

Mention of issues with crime and housing in Hemet, California

Mention of potential growth in Jacksonville's housing market

Some viewers are skeptical about the current state of the housing market and the motivations behind buying property

Some viewers are sharing personal experiences with rent increases or lack of rent decreases in their areas

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.