Blackstone's Losses Shake US Housing Market: Insights & Forecasts

- Authors

- Published on

- Published on

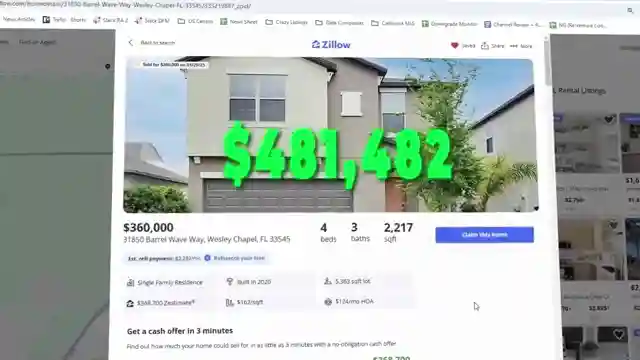

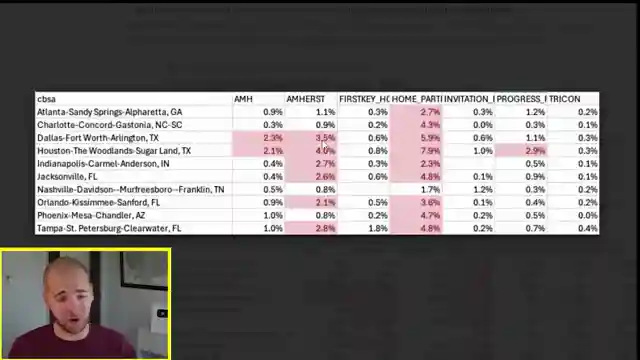

In a shocking twist, Reventure Consulting unveils Blackstone's staggering losses as they offload houses at a loss, like a property bought for $490,000 in 2022 sold for $360,000, marking a 27% decrease. The domino effect continues as Blackstone liquidates Home Partners of America, holding over 28,000 homes across the US. The housing market tremors as Wall Street landlords grapple with soaring property costs, taxes, and interest rates, leading to a 50% plummet in investor purchases. Not just Blackstone, but big players like Amherst and American Homes for Rent are also shedding properties, impacting markets in Dallas and Houston. The looming question arises: could these sales trigger a market crash?

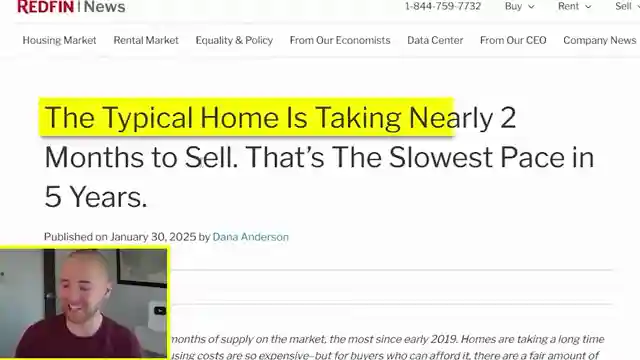

Zooming into Wesley Chapel, Florida, a Blackstone property sale at a hefty discount sends shockwaves through the neighborhood, affecting nearby home values. Despite scattered instances of slashed prices, overall home values in places like Tampa only witness a slight annual drop. Wall Street giants sound the alarm, claiming US homes are overpriced by up to 35%, reflected in stock prices of key players like Invitation Homes and American Homes for Rent. Invitation Homes, with a colossal 880,000-home portfolio, sees its stock price dwindling, hinting at market uncertainties. The math doesn't add up for large housing investors facing a profitability crunch due to low cap rates and high borrowing costs.

Reventure Consulting steps in, urging vigilance and data reliance to navigate the turbulent housing market. By analyzing home value growth and market trends on their platform, individuals can gain a deeper understanding of the shifting landscape amidst these seismic changes. The stage is set for a showdown as the housing market braces for a potential upheaval, with sellers clinging to high prices against a backdrop of dwindling demand and escalating inventory. Amidst the chaos, Reventure Consulting stands as a beacon, offering insights and forecasts to guide individuals through the stormy seas of the housing market.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Blackstone dumping houses across U.S. (30% discounts in Florida) on Youtube

Viewer Reactions for Blackstone dumping houses across U.S. (30% discounts in Florida)

Blackstone selling properties at a $130,000 loss

Home Partners of America being shut down

Housing market in Florida experiencing significant price increases

Concerns about corporations buying homes and causing housing monopolies

Calls for significant drops in home prices to make them more affordable for young people

Criticisms of investors artificially inflating home prices

Concerns about wealthy investors continuing to drive up home prices by acquiring available inventory

Discussion about the difficulty of the present generation in investing and utilizing money

Comments about the high costs of homeownership in Florida

Criticisms of corporate greed and its impact on the housing market

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.