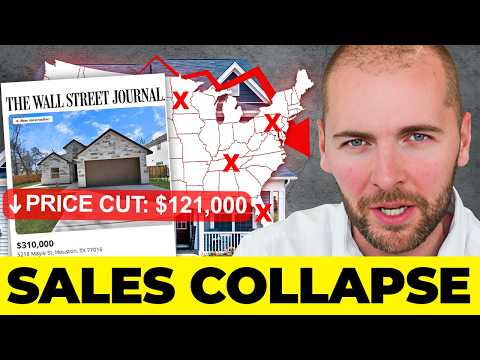

The Wall Street Journal Report: Impact of Declining Home Buyer Demand on Real Estate Market

- Authors

- Published on

- Published on

In a recent episode of Reventure Consulting, shocking revelations from The Wall Street Journal have sent tremors through the real estate world. The data paints a grim picture of a massive drop in home buyer demand, sparking fears of a downturn in the 2025 housing market. The report highlights a concerning trend where older, wealthier buyers, particularly married couples, dominate the market. First-time home buyers have dwindled to a mere 24%, a stark contrast to the 44% seen in the early '80s. This demographic shift is reshaping the landscape of home sales, with luxury properties driving up average prices while lower-end homes struggle to find buyers.

As the housing market grapples with these seismic shifts, certain cities are already feeling the pinch with prices on a downward spiral. Places like Cape Coral, Northport Sarasota, and Naples are witnessing significant declines, painting a stark contrast to the overall national trend of rising prices fueled by inventory shortages. The disparity in inventory levels between regions like the Northeast and Florida is creating a tale of two markets, where scarcity in one area drives prices up while oversupply in another leads to a price slump. These regional nuances underscore the complexity of the current real estate landscape, urging buyers and investors to look beyond national averages and delve into local market dynamics.

The parallels drawn between the current situation and the 2008 housing crisis are hard to ignore, with demand plummeting to levels reminiscent of that tumultuous period. However, key differences emerge, notably the absence of a substantial rise in inventory in certain regions and the lack of widespread economic hardship. The looming specter of a declining buyer demand, as highlighted by The Wall Street Journal, raises concerns about the future trajectory of the US housing market. Demographic shifts towards an older population and declining family formations could pose significant challenges, painting a sobering picture of what lies ahead for the real estate sector.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch It's worse than 2008. WSJ reports massive collapse in home sales to worst level in 30 years. on Youtube

Viewer Reactions for It's worse than 2008. WSJ reports massive collapse in home sales to worst level in 30 years.

Lowest level of buyer demand in 30 years

Concerns about home prices not dropping significantly

Impact of high prices on affordability for young and middle-aged individuals

Speculation on the role of corporations in the housing market

Observations on low inventory and interest rates affecting selling decisions

Calls for a crash in home prices nationwide

Challenges faced by future buyers in the current housing market

Impact of stagnant wages on affordability

Comments on the unaffordability of housing and the rental crisis

Speculation on the future of home prices and ownership opportunities

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.