2025 Housing Market Shift: Prolonged Selling Times, Buyer Advantage, and Seller Price Resistance

- Authors

- Published on

- Published on

In a stunning revelation, Redin Fin's latest data paints a bleak picture of the 2025 housing market. Sellers are in a panic as homes sit unsold for an unprecedented amount of time, with the average home taking a staggering two months to find a buyer - the slowest pace seen in five years. This shift has transformed the market into a buyer's paradise, where buyers hold all the cards, choosing from a plethora of available properties while sellers watch in dismay. Despite this clear imbalance, sellers remain stubborn, refusing to budge on prices even as days on the market increase and the supply of homes reaches a high of 5.2 months.

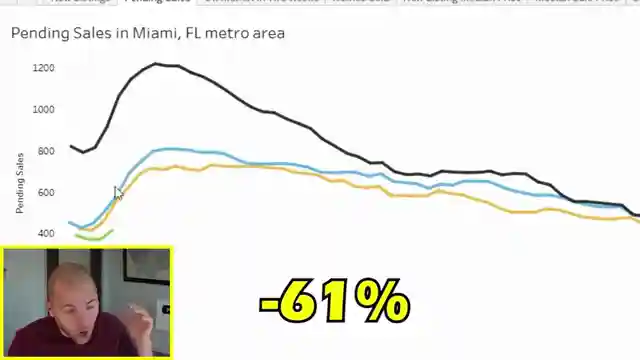

The median asking price for houses has soared by 5.2% year-over-year, a perplexing move considering the dwindling demand and extended selling times. The housing market finds itself at a perplexing crossroads, with sellers clinging onto hope while buyers remain elusive. Pending home sales have plummeted by a staggering 9.4% year-over-year, marking the most substantial decline since September 2023 and raising red flags about the market's future trajectory. The year 2024 saw home sales plummet to their lowest levels since 1995, painting a grim picture of the market's current state.

Cities like Miami, Atlanta, San Diego, and Houston have witnessed significant drops in pending sales, with Miami experiencing a notable 25% decline year-over-year. Despite the decline in sales, prices in Miami have yet to reflect this downturn, showcasing a puzzling disparity between supply and demand. Inventory levels have surged in various Florida counties, hinting at potential price adjustments on the horizon. Looking ahead, the 2025 housing market is poised for a reckoning, with sellers likely to face the harsh reality of overpricing their properties and the need for swift price corrections to entice wary buyers.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Redfin reports massive shift. DOM skyrockets to highest level in over 5 years. on Youtube

Viewer Reactions for Redfin reports massive shift. DOM skyrockets to highest level in over 5 years.

DOM at highest level in 5 years

Pending sales continue to collapse

Sellers need to wake up

Market shifting

Potential buyers advised to hold strong

Housing market inflated and oversaturated

Listing prices being raised and lowered repeatedly

Concerns about market bubble popping

Speculation by sellers

Impact of tariffs on building costs

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.