Protect Your Assets: The Key to Safely Self-Managing Rental Properties

- Authors

- Published on

- Published on

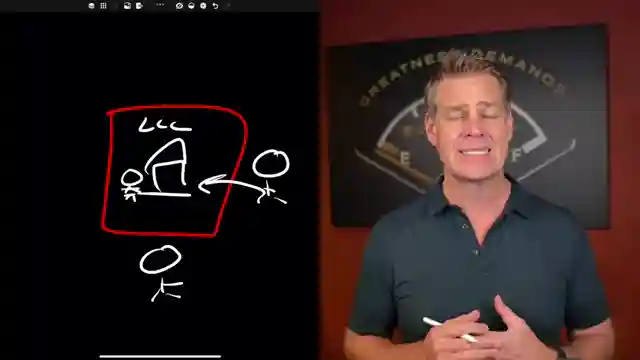

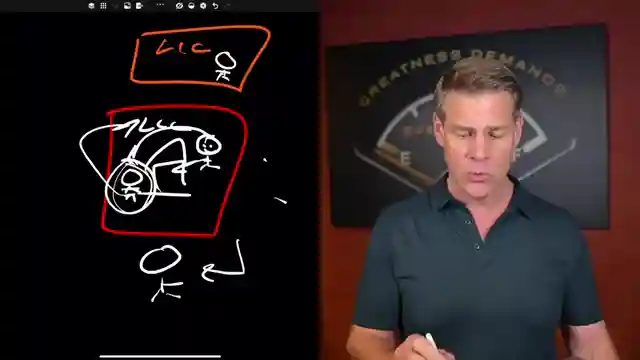

In this riveting episode, Clint Coons Esq. delves into the perilous world of self-managing rental properties, a treacherous endeavor fraught with legal landmines. With the gusto of a seasoned explorer, Clint uncovers the harrowing tale of a landlord who, despite sheltering his property under an LLC, found himself personally embroiled in a tenant dispute. The culprit? Self-management. Yes, you heard that right. By taking matters into his own hands, this unsuspecting landlord unwittingly exposed himself to a legal storm of epic proportions.

But fear not, dear viewers, for Clint is not one to leave you stranded in the legal wilderness. No, he offers a beacon of hope in the form of a simple yet ingenious solution: the management LLC. Like a knight in shining armor, this entity swoops in to shield landlords from the fiery arrows of personal liability. By creating a separate management LLC, landlords can navigate the turbulent waters of rental property management with confidence and peace of mind.

Clint's message is clear: in the high-stakes game of property management, one must arm oneself with the right tools for the job. The management LLC emerges as a crucial piece of armor in the landlord's arsenal, offering protection against unforeseen legal attacks. So, buckle up, dear viewers, and heed Clint's sage advice. The road to rental property success may be fraught with challenges, but with the right strategies in place, victory is within reach.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch The Hidden Dangers of Self-Managing Real Estate (What You Need to Know) on Youtube

Viewer Reactions for The Hidden Dangers of Self-Managing Real Estate (What You Need to Know)

Question about the necessity of having a management LLC if it sits under a WY LLC

Inquiry about setting up a management LLC in WY for out-of-state properties while living in CA

Ownership structure for a management LLC in WY for anonymity and protection

Recommendation on having an umbrella policy for a property management LLC

Clarification on the role of a management company in asset protection

Concern about personal liability in a single-member management LLC

Possibility of a C-corp being a property management entity within an Anderson structure

Inquiry about legal fees for drafting Resignation and Trustee Successor Deed documents

Question about going after a shake-down lawsuit

Humorous comment about self-managing properties and avoiding parasitic mites

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.