Unlock Financial Freedom: Buying Multifamily Properties Without Income

- Authors

- Published on

- Published on

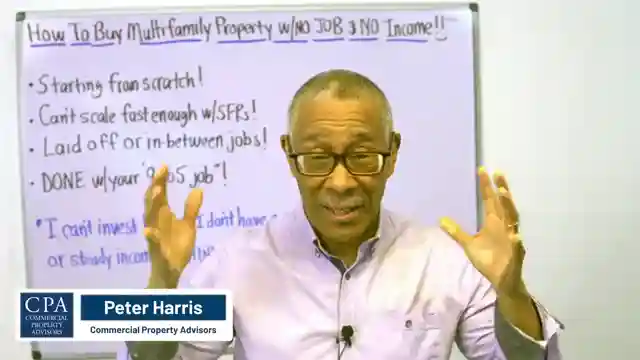

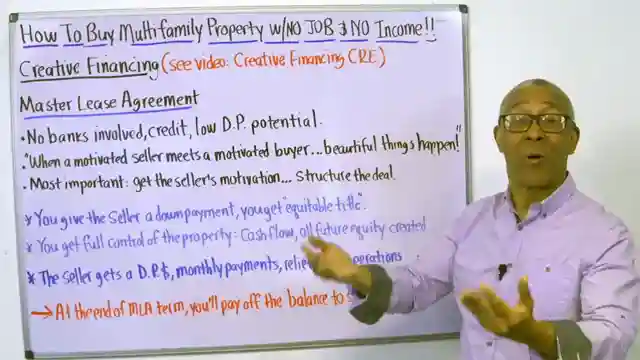

Today on Commercial Property Advisors, we're shattering the notion that buying multifamily properties without a job or income is a pipe dream. The team reveals strategies like non-qm multifam loans and creative financing, particularly the powerful master lease agreements. These methods offer a glimmer of hope for those feeling stuck with single-family rentals or facing the harsh reality of job loss.

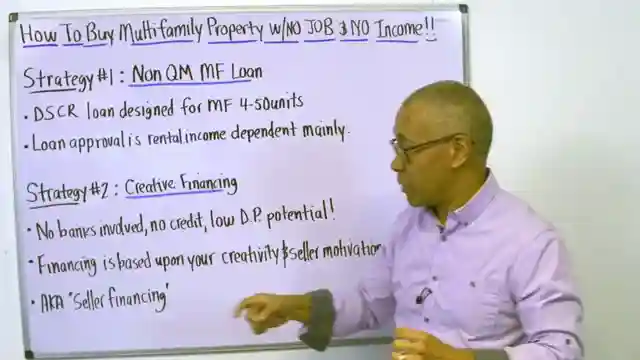

When it comes to non-qm multifam loans, forget about traditional requirements like W2 forms. Instead, focus on your credit score and the income generated by the property. Creative financing, on the other hand, involves no banks, low down payments, and a deep dive into seller motivations. This channel specializes in the intricate dance of master lease agreements, a game-changer in the commercial real estate realm.

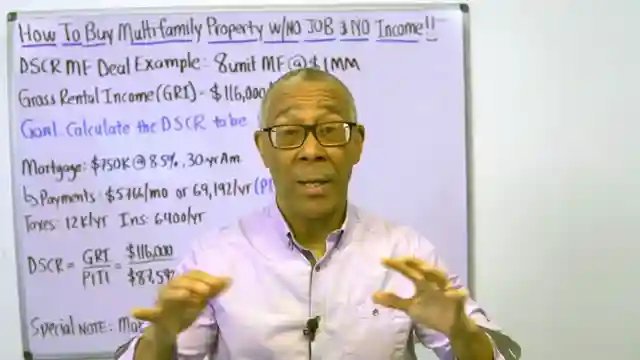

Understanding the importance of calculating the debt service coverage ratio (DSCR) is paramount for loan approval. A ratio above 1.2 is the golden ticket to attracting lenders like bees to honey. The channel walks you through a practical case study, illustrating how to crunch the numbers for an 8-unit property. Master lease agreements, with their win-win nature, grant buyers full control over the property and the promise of future equity gains.

Knowing when to deploy a master lease is crucial for success. For instance, when a seller is on the brink of burnout and desires to offload the property while maintaining some income, a master lease agreement could be the perfect solution. So buckle up, because Commercial Property Advisors is here to guide you through the maze of commercial real estate investing, showing that financial freedom is within reach, even without a traditional job or income.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How To Buy Multifamily Property with No Job or Income on Youtube

Viewer Reactions for How To Buy Multifamily Property with No Job or Income

Many users are expressing a desire to leave their 9-5 jobs and improve their financial situations

Some users are interested in purchasing multi-family properties

Questions about finding good deals and buying without money are raised

Some users mention struggling with debt to income ratio and high DTI

Mentions of wanting to invest in real estate full-time and seeking guidance or mentorship

Comments about the need for multiple income streams and generating wealth for future generations

Some users express frustration with financial limitations and seeking ways to change their circumstances

A user criticizes the video for potentially spreading misinformation

Positive comments praising the speaker's energy and knowledge are also present

Related Articles

Mastering Multifamily Investments: Key Lessons for Success

Learn crucial multifamily property investment lessons from Commercial Property Advisors: prioritize cash flow and reserves, invest in top-notch property management, understand neighborhoods, start small, and take action over analysis paralysis for success in real estate.

Mastering Real Estate Funding: The 3 Essential Keys

Learn the three essential keys to effortlessly raising money for real estate deals from Commercial Property Advisors. Discover how to assess deal worthiness, position yourself attractively, and align opportunities with investor needs for successful funding.

Maximize Wealth: Why Choose Commercial Real Estate Over Stocks

Discover why Commercial Property Advisors recommends commercial real estate over stocks. Learn about predictability, cash flow, leverage, tax benefits, and building a lasting legacy through tangible assets. Gain control and stability in wealth-building today.

From Layoff to Real Estate Tycoon: Jaden's $14M Success Story

Follow Jaden's inspiring journey from corporate layoff to owning $14 million in multifamily properties. Learn how strategic investing and perseverance led to his success in commercial real estate.