Protecting Multiple Businesses: LLC Structuring Tips

- Authors

- Published on

- Published on

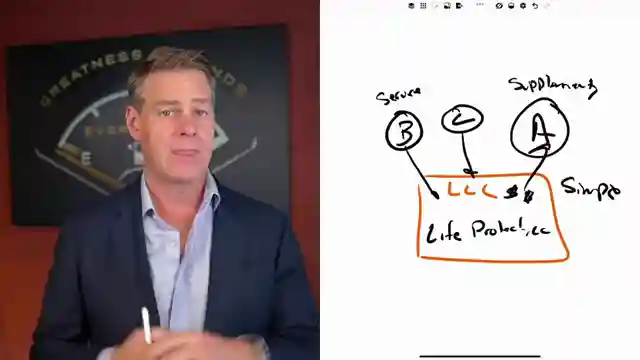

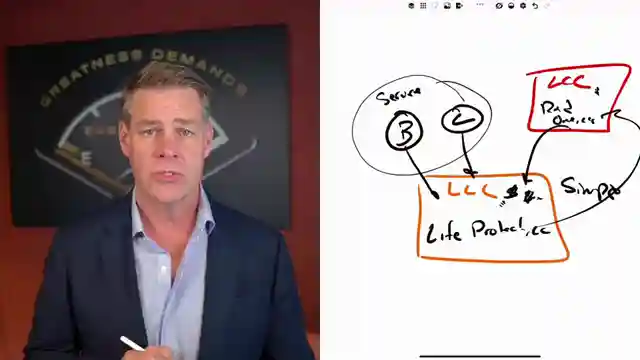

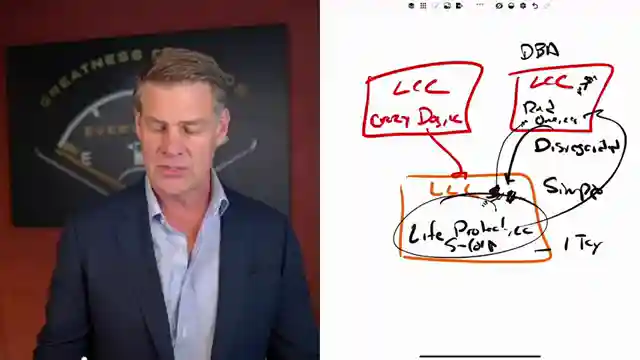

In this riveting episode by Clint Coons Esq. | Real Estate Asset Protection, the team delves into the perilous world of running multiple businesses under a single limited liability company. They uncover the treacherous risks involved and unveil a strategic roadmap to shield oneself from potential liabilities. A client's harrowing tale of liability exposure sparks a fiery discussion on the art of restructuring for maximum protection. The team unveils a brilliant plan to safeguard assets while maintaining a simple tax structure for these diverse businesses.

With the precision of a seasoned race car driver, Clint Coons Esq. and his team steer the conversation towards the importance of creating separate LLCs for each business activity. By deftly maneuvering through the legal landscape, they establish a rock-solid foundation to shield businesses from potential legal storms. Through the creation of licensing agreements and separate bank accounts, they erect impenetrable barriers to safeguard financial interests while ensuring tax simplicity.

Like a master craftsman shaping a masterpiece, the team meticulously crafts a structure where income seamlessly flows to the parent company for tax purposes. They deftly navigate the complexities of anonymity in structuring LLCs based on the nature of business activities, ensuring maximum protection. Viewers are not just spectators but active participants in this high-octane journey towards securing their businesses in the ever-changing landscape of entrepreneurship. So buckle up, engage with the team, and embark on a thrilling ride towards safeguarding your business ventures in style.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Running Multiple Businesses Under One LLC? Here’s How to Limit Liability on Youtube

Viewer Reactions for Running Multiple Businesses Under One LLC? Here’s How to Limit Liability

Request for a video comparing Wyoming vs Delaware LLCs

Structuring a business dealing with real estate and service businesses in multiple locations

Setting up LLCs for an online book business and a woodworking business

Concerns about LLCs being trustee of multiple land trusts and using d/b/a

Using multiple LLCs for a Turo business in Florida

Mitigating risk in PLLCs in states requiring PLLCs

Tax implications of one business buying products or services from another business

Making a derelict LLC disregarded and transferring credit history to another LLC

Structuring Short-Term rentals under separate LLCs

Setting up a single-member LLC with an SSN and private banking for liability protection

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.