US Housing Market Crisis: Builders Cut Prices Amid Record Inventory Surplus

- Authors

- Published on

- Published on

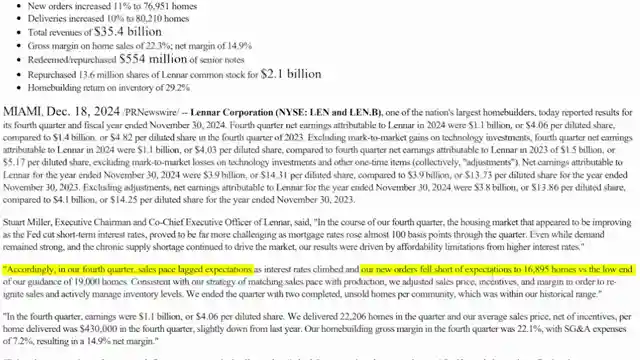

In a riveting exposé, Reventure Consulting unveils a shocking reality gripping the American housing market. Home builders across the nation are facing a monumental inventory surplus not witnessed since the catastrophic 2008 housing crash. This surplus has forced builders to slash prices dramatically, with some even resorting to desperate measures such as offering 4.5% mortgage rates. Lenar, the second-largest home builder in the U.S., reported a troubling 9% revenue decline, sending shockwaves through the industry. Similarly, DR Horton, America's largest home builder, experienced a stock plunge due to a significant number of unsold homes on their lots.

The unprecedented supply pipeline on builder lots, surpassing levels seen even during the 2008 crash, paints a grim picture for the housing market heading into 2025. With over 300,000 homes for sale in the South alone, builders are grappling with the challenge of offloading properties amidst dwindling demand. Despite efforts to entice buyers with price cuts and mortgage rate incentives, the market remains sluggish. Lenar's CEO highlighted the difficulties faced as mortgage rates surged, impacting sales projections and new orders. The situation is particularly dire in states like Texas, Florida, North Carolina, California, Arizona, and Georgia, where building permits are most active.

The smile states in the South, known for their warm climates, are now facing an oversupply of homes, creating a buyer's paradise but a seller's nightmare. As builders like Lenar and DR Horton navigate through the turbulent market conditions, their pricing power and profit margins remain intact, allowing them to weather the storm by offering competitive deals. However, existing homeowners find themselves in a tough spot, competing with builders offering newer, more affordable homes. The looming downturn in Florida and Texas, characterized by rising inventory and falling prices, contradicts the national home price indexes, which continue to soar, masking the local market realities. Despite the post-election surge in sentiment following Trump's presidency, affordability concerns persist, potentially leading to further price drops in 2025. Prospective buyers are urged to exercise caution, stay informed about market trends, and leverage tools like the Reventure app to make sound home buying decisions amidst the housing market turmoil.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch It’s 2008 all over again. Home builders reporting biggest spike in unsold homes in a decade. on Youtube

Viewer Reactions for It’s 2008 all over again. Home builders reporting biggest spike in unsold homes in a decade.

Concerns about the high prices of houses and the quality of new builds

Speculation on the future of the housing market and potential crashes

Frustration with builders and price gouging

Impact of investors on the housing market

Comments on the affordability of homes in different regions

Skepticism about the housing market crash predictions

Criticism of the housing market and builders

Personal stories and experiences with the housing market

Political comments on taxes and economic issues

Viewer dissatisfaction with the content and predictions of the channel

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.