US Housing Market Alert: 0% Down Mortgages Resurface, Echoes of Pre-2008 Crisis

- Authors

- Published on

- Published on

In a riveting exposé by Reventure Consulting, the return of 0% down mortgages in the US housing market is causing quite a stir. This echoes the ominous signs seen before the 2008 crisis, with builders and sellers resorting to desperate measures to move their stagnant inventory. Take, for instance, a Florida builder boldly flaunting 22 homes with 0% down offers, a clear indicator of the mounting pressure in the market. With the highest level of home builder inventory since the tumultuous years of 2006-2008, the housing sector is teetering on the edge of a precipice, facing downward price trends.

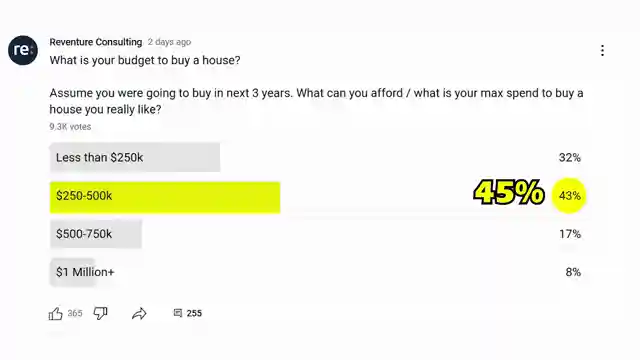

Despite these glaring red flags, sellers seem to be living in a bubble of denial, listing properties at exorbitant prices that defy market logic. The survey conducted by Reventure Consulting unveils a stark reality: the majority of potential buyers are constrained by budgets under $500,000, underscoring the growing mismatch between property prices and buyers' financial capabilities. While rental rates in select US markets are witnessing a decline, particularly in areas like Tampa and Austin, the oversupply of rental properties, notably townhomes, is driving rents down, offering a glimmer of hope for renters and aspiring homeowners.

Builders, in a bid to entice buyers, are resorting to leveraging low down payment mortgage programs like FHA to offer the enticing 0% down mortgages. However, this risky move harkens back to the perilous practices of the mid-2000s, raising concerns about the sustainability of such schemes. The struggles faced by builders like LGI Homes, who plan to convert unsold homes into rentals, shed light on the challenges pervading the industry. As Lenar, a major player in the market, grapples with declining margins and resorts to record incentives to bolster sales, the housing sector is navigating treacherous waters with uncertain outcomes. Amidst Zillow's somber forecast of minimal home price growth and anticipated declines in numerous metro areas, the housing market stands at a critical juncture, poised on the brink of a significant downturn.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch You won't believe it (0% down mortgages are back) on Youtube

Viewer Reactions for You won't believe it (0% down mortgages are back)

Builders in Florida, Georgia, and Tennessee are offering 0% down signs, indicating desperation to sell homes due to high inventory levels.

Some buyers are holding off due to high prices, anticipating potential drops in home values.

Home prices have significantly increased in certain areas, leading to concerns about affordability and sustainability.

Zero down mortgages are raising concerns about future foreclosures and the importance of financial education.

Some buyers are waiting on the sidelines, hoping for prices to fall before considering purchasing a home.

Concerns about the quality of new homes being built, with mentions of cheap materials and poor construction.

Observations about the housing market being unsustainable and comparisons to the 2008 crash.

Comments on the difficulty of affording homes due to additional costs like insurance and taxes.

Speculation on potential market collapses and the impact of political figures on housing prices.

Mixed opinions on the current state of the housing market, with some expressing skepticism and others acknowledging the challenges of buying a home.

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.