US Census Data Reveals Population Exodus from Florida, Texas, and Arizona in 2024

- Authors

- Published on

- Published on

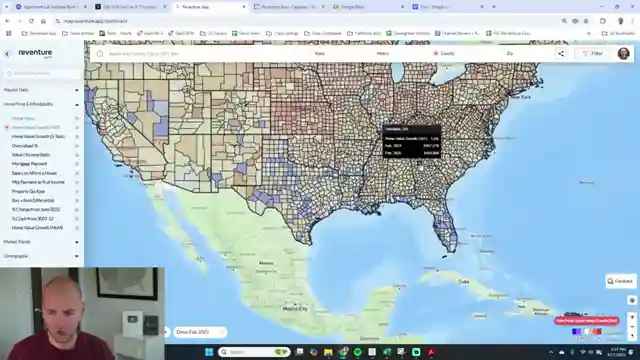

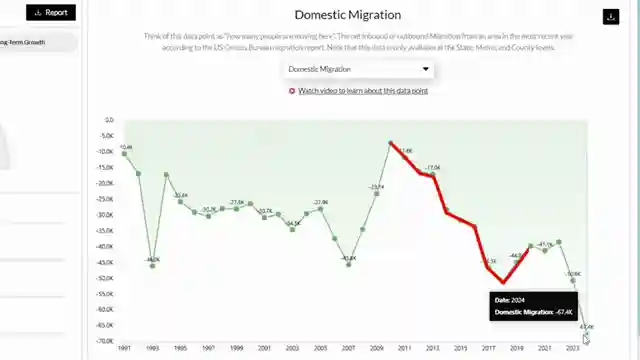

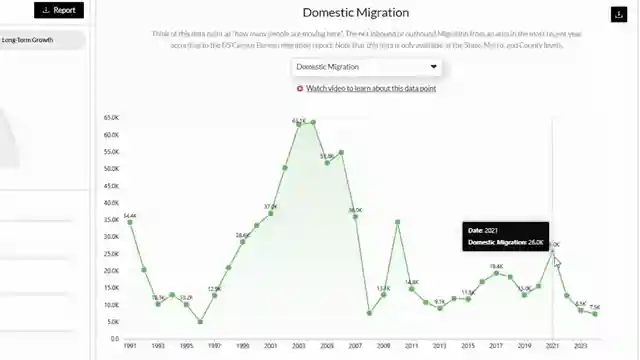

In a jaw-dropping revelation, Reventure Consulting unveils shocking data from the US Census Bureau, indicating a mass exodus from states like Florida, Texas, and Arizona. The numbers paint a grim picture for local housing markets, with Miami-Dade County shedding a whopping 67,000 residents in 2024 alone. Dallas and Maricopa County are not far behind, facing significant losses as well. This seismic shift in migration patterns is sending ripples through the real estate landscape, with home prices in these states already showing signs of decline.

The data exposes a stark reality: the once-thriving pandemic boom towns are losing their appeal, while the Northeast and Midwest are experiencing a resurgence in population. Hillsboro, Pinellas, and Orange Counties in Florida are among the hardest hit, with historic losses in domestic migration. Surprisingly, even Southeast Florida, long touted as a magnet for newcomers, is witnessing a decline in residents. The myth of perpetual growth in the Sunshine State is shattered by hard-hitting census figures.

Amidst the chaos, Manhattan stands out as a beacon of stability in the Northeast, with migration losses tapering off. Conversely, areas in New Jersey and California are grappling with significant outflows. Texas remains a popular destination, although the rate of incoming residents has slowed compared to previous years. Florida, while still attracting newcomers, is experiencing a notable decrease in migration numbers. Reventure Consulting emphasizes the critical importance of understanding these migration trends for savvy investors and homebuyers looking to navigate the turbulent real estate market of 2025.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch It's official: Florida and Texas are losing people (80% migration drop) on Youtube

Viewer Reactions for It's official: Florida and Texas are losing people (80% migration drop)

Domestic migration is a more stable indicator of growth compared to international migration due to recent changes in border crossings.

People moved to Florida and Texas to escape high cost of living in NY and CA, but now some are moving to SC and Alabama.

Some residents express relief at the decrease in migration in Texas and Florida.

Concerns about overdevelopment in Florida leading to an excess of properties.

Some residents have left Florida due to increased costs and population growth.

Observations on the changing demographics in various neighborhoods.

Speculation on the reasons for people leaving certain states, such as housing insurance costs.

Comments on the impact of political factors on migration.

Mention of the potential impact of low birthrates and immigration on the population.

Personal anecdotes about moving between different areas in Florida.

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.