Top 10 US Cities Where Home Prices Are Expected to Drop in 2025

- Authors

- Published on

- Published on

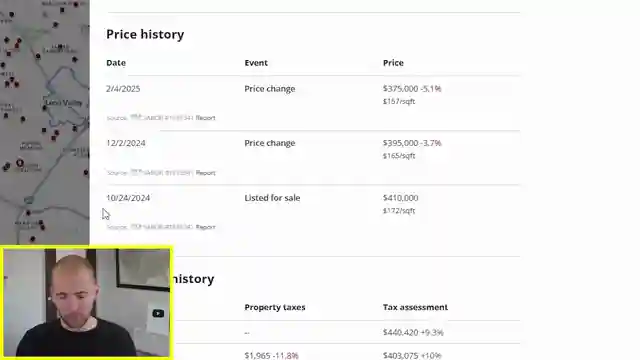

In a riveting expose by Reventure Consulting, the top 10 cities in America where home prices are set to plummet in 2025 have been unmasked. From the bustling streets of Dallas to the sunny shores of Sarasota-Northport, the housing market is trembling under the weight of soaring inventory and slashed prices. San Antonio finds itself drowning in a sea of 10,500 homes for sale, leaving sellers in a frenzy to offload properties as days on the market stretch to a staggering 78. Meanwhile, Port St. Lucie stands on the brink of a potential market crash, with prices overvalued by a whopping 35%.

As we shift gears to the Lone Star State, Austin emerges as the poster child for a housing market in freefall, with values plummeting by a jaw-dropping 19.1%. The once-thriving city now wears the crown of the top housing crash market, a title no one would envy. Over in the sunshine state, Palm Bay-Melbourne is grappling with a 1.9% dip in prices, a telltale sign of the market's descent into chaos. Colorado Springs, a military town south of Denver, has witnessed a 4.1% decline in prices, signaling turbulent times ahead as a massive wall of inventory looms large over the city.

But the real shocker comes as we zoom into the heart of Denver, where a staggering 66% inventory surplus has sent shockwaves through the housing market. With 6,500 homes up for grabs, the Mile-High City is teetering on the edge of a precipice, with prices expected to nosedive in the near future. And as we brace for impact in Lakeland, Florida, the market finds itself 26% overvalued, with prices already on a downward spiral. However, the grand finale awaits in Cape Coral-Fort Myers, where values have plummeted by 5.6% in the last year alone. With a history of a 57% crash in the last downturn, the city stands as a stark reminder of the tumultuous rollercoaster ride that is the American housing market.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Top 10 Cities where Home Prices will Crash in 2025 on Youtube

Viewer Reactions for Top 10 Cities where Home Prices will Crash in 2025

List of 10 cities where home values are dropping and expected to fall more in 2025

Concerns about housing catastrophe due to high debt and potential foreclosures

Observations on specific cities like Dallas, Sarasota, San Antonio, Austin, Palm Bay, Colorado Springs, Denver, Lakeland, and Cape Coral

Comments on the current state of the housing market in different locations

Concerns about taxes and insurance affecting home affordability

Speculation on the impact of investors on the housing market

Comments on the high prices, interest rates, and inventory in the housing market

Concerns about the future of the housing market and potential economic challenges

Criticisms of the housing market hyperboles and overpriced properties

Speculation on potential inventory increases in certain areas

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

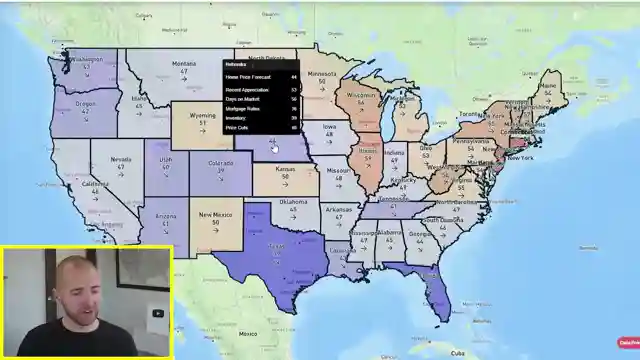

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.