Secure Trading Profits: Asset Protection Strategies with Wyoming LLC

- Authors

- Published on

- Published on

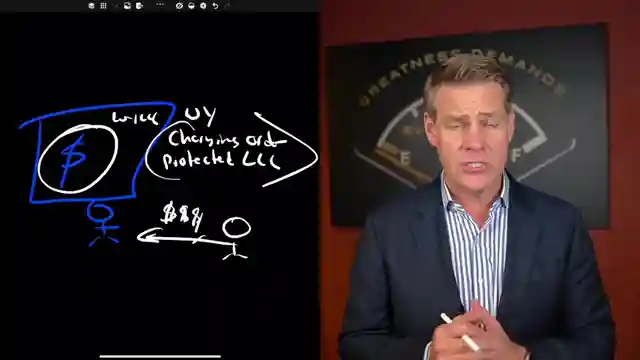

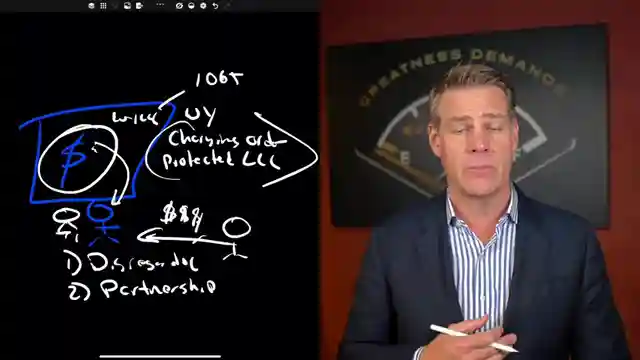

In this riveting video from Clint Coons Esq., viewers are taken on a thrilling journey into the world of safeguarding trading profits through ingenious asset protection strategies. By setting up a limited liability company in the rugged terrain of Wyoming, traders can shield their brokerage accounts from potential creditor attacks like a fortress standing strong against enemy siege. This charging order protected LLC serves as a formidable barrier, ensuring that trading profits remain untouchable by personal creditors, much like a knight in shining armor protecting its kingdom.

When it comes to tax classification, traders are faced with the exhilarating choice between a disregarded LLC or a partnership, each path offering its own set of risks and rewards akin to navigating treacherous waters in search of hidden treasure. For those daring traders in need of real-time feeds, the option of a personal property trust owned by the LLC presents a daring solution to bypass costly obstacles and secure vital information like a skilled spy infiltrating enemy lines. This clever workaround allows traders to enjoy the best of both worlds - protection from potential threats while gaining access to critical real-time data essential for successful trading maneuvers.

As Clint Coons Esq. expertly guides viewers through the intricate web of asset protection strategies, a sense of empowerment and security washes over traders like a wave of relief crashing against the rocky shores of uncertainty. The knowledge and wisdom shared in this video serve as a beacon of hope in a sea of financial risks, offering traders the tools they need to navigate the treacherous waters of trading with confidence and resilience. So buckle up, hold on tight, and embark on this exhilarating adventure towards financial security and peace of mind in the unpredictable world of trading.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Here's How to Protect Your Trading Account From Lawsuits and Creditors on Youtube

Viewer Reactions for Here's How to Protect Your Trading Account From Lawsuits and Creditors

Using a personal bank account to pay to open a WY LLC

Self-employment tax for a disregarded entity LLC with dividend investments

Converting an existing investment account to an LLC

"Must have" clauses for a PPT

1031 exchange into a real estate purchase under a bank loan

Updating trust beneficiary with the broker

Opening an account under a C corporation

Using the same Wyoming LLC for rental properties

Concerns about divorce

Schwab's $250,000 relationship minimum requirement

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.