Maximize Retirement Savings: Real Estate Strategies with Self-Directed IRAs

- Authors

- Published on

- Published on

In this exhilarating episode by Clint Coons Esq., brace yourselves as we dive headfirst into the thrilling world of real estate investment using self-directed IRAs. Strap in, folks, because your retirement account is about to become the key to unlocking a realm of opportunities in the property market. Clint unveils four adrenaline-pumping strategies that will have you on the edge of your seat: direct IRA investment, partnering with another IRA, teaming up with your own IRA, and the heart-pounding feat of borrowing tax-free from your IRA.

As Clint revs up the engines, he emphasizes the importance of revamping your traditional IRA into a self-directed powerhouse, allowing you to break free from the shackles of conventional stock and bond investments. Buckle up as he navigates the treacherous terrain of minimizing liability exposure when venturing into the high-octane world of real estate. By structuring your IRA and assets with precision, you can avoid catastrophic breakdowns like prohibited transactions and safeguard your hard-earned wealth from potential IRS roadblocks.

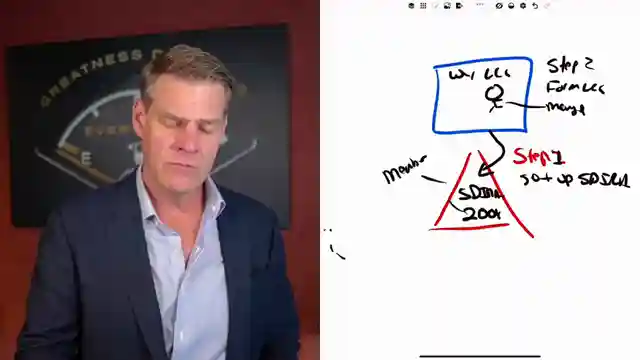

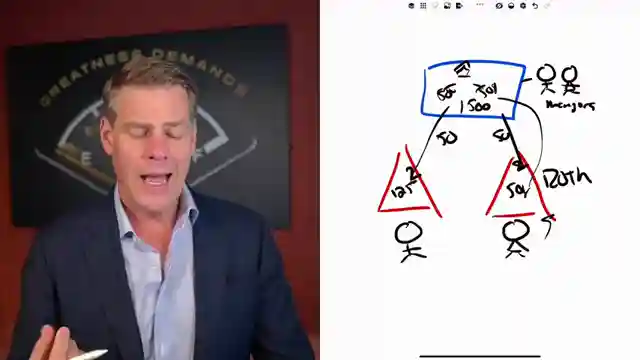

Picture this: Clint takes you on a high-speed chase through the process of setting up a self-directed IRA and forming a turbocharged LLC with your IRA as the sole member. This strategic maneuver not only shields your IRA from legal potholes but also turbocharges your ability to invest in multiple properties without skidding off course. Revving up the excitement, Clint reveals the adrenaline-fueled tactic of partnering with another daredevil's IRA, where you can join forces to conquer the real estate landscape and split profits like true road warriors. So gear up, adrenaline junkies, as Clint Coons Esq. revs up the engine of financial freedom and propels you into the fast lane of real estate investment like never before.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How To BUY REAL ESTATE From Your Self Directed IRA TAX FREE on Youtube

Viewer Reactions for How To BUY REAL ESTATE From Your Self Directed IRA TAX FREE

Discussion about age restrictions for certain investments

Questions about economic effects of certain investment strategies

Using Roth IRA for real estate investments and tax implications

Setting up LLCs for real estate investments and liability protection

Moving money out of SD IRA to a bank

Loans to Wyoming LLCs and charging order protection

Prohibited transactions with solo 401k and Irrevocable Trust

Clarification on setting up SD IRA for multiple LLCs

Limitations on living in certain properties

Prevalence of Wyoming LLCs in investment strategies

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.