Navigating the Tennessee Housing Bubble: Insights from Reventure Consulting

- Authors

- Published on

- Published on

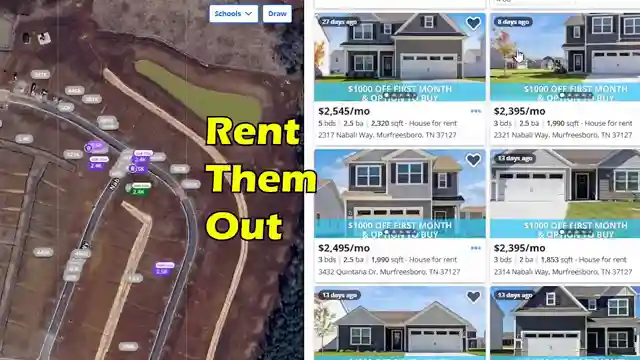

In this eye-opening video from Reventure Consulting, we witness a jaw-dropping phenomenon in the Tennessee housing market. Wall Street investors are swooping in like vultures, snapping up homes for rent to own schemes before they're even finished! It's a wild west out there, with prices being pushed to the limit by these profit-hungry investors. Pathway, the company behind this scheme, is dangling the carrot of homeownership after a three-year lease, but let's face it - they're playing a game rigged in their favor from the start.

The housing market bubble in the southern states, particularly in Tennessee and Florida, is on the brink of bursting. Builders are struggling to offload their overpriced properties to regular folks, resorting to selling to investors to keep the cash flowing. But how long can this charade last? The signs are all there - rising inventory, price cuts, and falling values - painting a grim picture for the market. It's a classic case of sellers refusing to face reality, clinging onto inflated prices in a desperate bid to avoid the inevitable crash.

Despite pockets of bidding wars in affluent neighborhoods, the broader market is in a slump. Demand is at its lowest in 14 years, with investors backing off and inventory piling up. It's a buyer's paradise in the making, with lower prices on the horizon for those savvy enough to wait it out. Reventure Consulting's advice? Arm yourself with knowledge using their app to navigate the turbulent waters of the housing market. With insights and forecasts at your fingertips, you'll be well-equipped to make informed decisions in these uncertain times.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Wall Street at it again! (Landlords report 90% vacancy rate in rental communities) on Youtube

Viewer Reactions for Wall Street at it again! (Landlords report 90% vacancy rate in rental communities)

Similarities to the housing market before 2008 crash

High inventory of new homes for sale

Wall Street slowing down purchases but still buying in bulk from builders

Rents dropping in Sun Belt housing markets due to influx of rental inventory

Prices dropping in Florida, Texas, Arizona, and soon in Tennessee

Concerns about homes being treated as investments for Wall Street

Criticism of investors buying up homes for rental purposes

Calls for regulation on the number of homes owned by individuals

Comments on the affordability crisis in the housing market

Skepticism towards current housing prices and market conditions

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.