Navigating Economic Turbulence: US Challenges & Housing Market Impact

- Authors

- Published on

- Published on

In a riveting update from Reventure Consulting, the US economy is facing a turbulent storm in 2025. Reports of a sharp decline in consumer spending and a series of corporate layoffs are sending shockwaves through the nation. From Southwest to Chevron and Meta, major players are wielding the layoff axe, particularly targeting white-collar workers. This spells trouble for the economy, with uncertainty and volatility looming large on the horizon.

The spotlight then shifts to the housing market, with affluent areas like Brookhaven in Atlanta bracing for impact. As consumer confidence wanes and retail sales plummet, the housing sector is feeling the heat. Despite the gloomy outlook, pockets of stability emerge in wealthier neighborhoods, where home values manage to hold their ground amidst the economic turmoil. Regional disparities come into play, with wealthier areas showing resilience while low-income regions struggle to stay afloat.

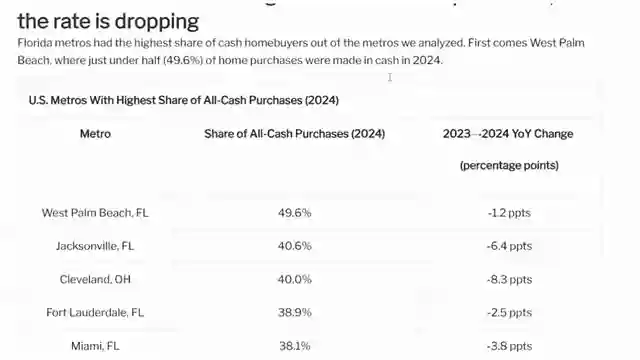

Amidst the chaos, concerns arise about the repercussions of government layoffs on high-income areas like Fairfax and Loudoun County outside DC. The mandate to return to the office, spearheaded by Trump, is causing a seismic shift in the workforce landscape. Workers who sought refuge in remote work during the pandemic are now forced to reconsider their living arrangements, potentially triggering a domino effect on housing demand. As the economy hurtles through uncertainty, individuals are urged to stay vigilant and monitor market trends closely, especially in key states like Atlanta, DC, Florida, and beyond.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch People have run out of money. Wall Street CEOs preparing for mass layoffs. on Youtube

Viewer Reactions for People have run out of money. Wall Street CEOs preparing for mass layoffs.

Concerns about the decline in retail sales and GDP forecasts

Frustration over home and car prices being overpriced

Criticism of government layoffs and treatment of federal workers

Comments on tech industry layoffs and job security

Calls for higher interest rates and criticism of tax cuts for the wealthy

Criticism of government spending and debt

Concerns about the economy and potential recession

Criticism of political figures and their policies

Personal anecdotes about housing market struggles

Comments on tax cuts and their impact on the economy

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.