Luxury Rental Market Crash: Impact on Landlords, Investors & Homebuyers

- Authors

- Published on

- Published on

Reventure Consulting uncovers the catastrophic downfall of the luxury rental market in America, with landlords teetering on the brink of financial ruin amidst soaring vacancies and rent slashes of up to 40%. The once-glamorous apartment buildings now stand desolate, a haunting reminder of the greed and miscalculations that have led to this epic crisis. Developers, in their reckless pursuit of profit, find themselves drowning in debt, forced to offer three months of rent-free living to entice tenants who have long deserted the concrete jungle.

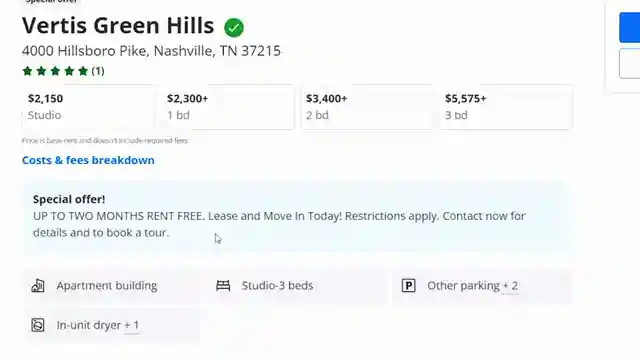

The exorbitant rental prices, like the staggering $15,600 for a mere studio apartment, fail to lure back the urban dwellers who have fled the cities during the pandemic. Even the most prestigious luxury properties are now offering discounts of up to 25%, a desperate attempt to fill the echoing void left by the fleeing populace. The commercial property market is in freefall, with a looming debt refinancing crisis on the horizon as interest rates soar to unprecedented heights, leaving many property owners gasping for financial air.

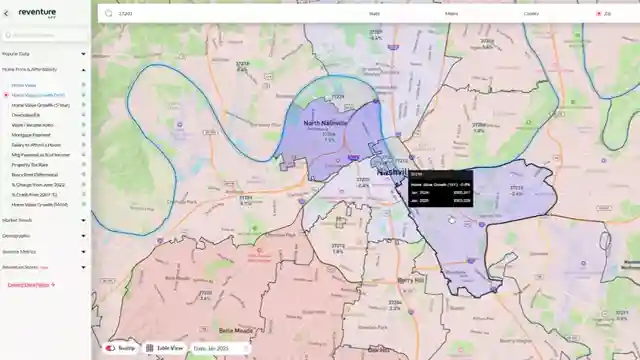

As the values of multifamily properties plummet, the once-thriving real estate landscape is now a barren wasteland of empty units and shattered dreams. The rental market crash reverberates through the economy, casting a foreboding shadow over cities like Nashville, where the once-booming construction industry now faces a bleak future. Amidst this chaos, investors are left reeling, grappling with record-low cap rates and escalating expenses that threaten to derail their financial aspirations. In the midst of this turmoil, there is a glimmer of hope for homebuyers as declining rents hint at potential price drops in the near future, offering a silver lining in an otherwise bleak housing market.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Rental rates cut 40%. Landlords on verge of bankruptcy. on Youtube

Viewer Reactions for Rental rates cut 40%. Landlords on verge of bankruptcy.

Luxury rental prices collapsing in Nashville

Lack of true luxury amenities in some apartments

Landlords raising rents annually

Concerns about housing market normalcy

Dislike for corporate bailouts

High rent prices in various locations

Impact of rent increases post-pandemic

Experiences with rent concessions and vacant units

Commentary on landlords and apartment prices

Desire for more affordable housing opportunities

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.