Florida Housing Market Crisis: Prices Drop, Inventory Soars

- Authors

- Published on

- Published on

In this thrilling exposé by Reventure Consulting, we dive headfirst into the tumultuous waters of the Florida housing market. Brace yourselves, folks, because we're on the brink of a catastrophic collapse reminiscent of the 2008 crisis. Prices are plummeting, inventory is skyrocketing, and it's shaping up to be a real nail-biter. Hold onto your seats as we uncover the nitty-gritty details of this housing market rollercoaster.

Florida, dear viewers, has a history of housing market woes, with prices nosediving by a staggering 49% from 2007 to 2012. Fast forward to today, and we find ourselves in a situation where prices are a hefty 20% overvalued. But here's the kicker - the overvaluation rates vary across different Florida metros, ranging from 23% to a whopping 36%. It's a real mixed bag out there, with sellers slashing prices left, right, and center.

The mainstream media has finally caught wind of this housing market mayhem, thrusting it into the spotlight for all to see. No longer just a topic for niche enthusiasts, the Florida downturn is making waves across the state. But amidst the chaos, some stubborn sellers are still clinging to sky-high price tags, oblivious to the storm brewing around them. As the market tiptoes into the early stages of this downturn, buyers and investors are left grappling with a landscape that's shifting beneath their feet.

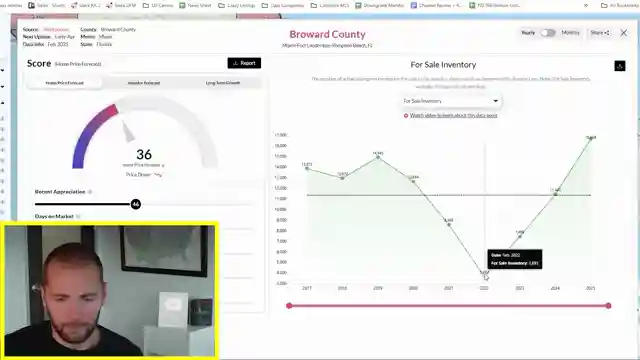

Local market insights paint a vivid picture of price cuts and inventory spikes in various Florida counties. From the west coast to Central Florida, the ripples of this housing market turbulence are being felt far and wide. With supply outweighing demand and Florida boasting the highest months of inventory in the nation, it's clear that we're in for a wild ride. As New York's housing market thrives in contrast, fueled by a reversal in migration trends, Florida finds itself at a crossroads. The exodus from the Sunshine State is a trend that shows no signs of slowing, setting the stage for a prolonged buyer's market with prices poised to plummet further. So buckle up, ladies and gents, because the Florida housing market saga is far from over.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Florida in big trouble. on Youtube

Viewer Reactions for Florida in big trouble.

Markets in Florida with the biggest inventory spike

Impact of COVID-19 on housing prices in Florida

Canadian snowbirds exiting the Florida market

Concerns about property taxes and insurance prices in Florida

Transaction costs and equity loss in real estate

Desirability of living in Florida due to natural disasters and insurance issues

Concerns about housing affordability for future generations

Potential impact of FHA foreclosures

Speculation on whether Florida's housing market adjustment is temporary or a crisis

Observations on the transient nature of Florida's population and its impact on housing inventory

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.