2025 Housing Market Analysis: Zillow Forecast, Price Cuts, and Buyer Standoff

- Authors

- Published on

- Published on

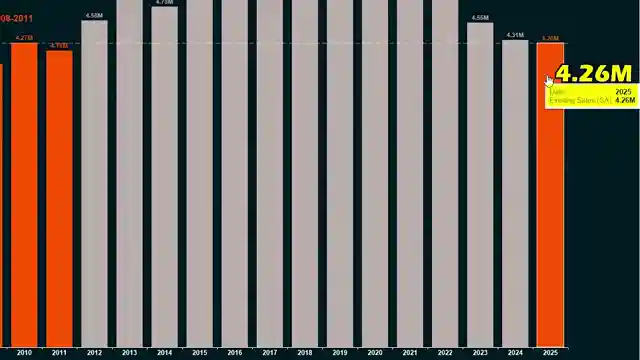

In this riveting episode of Reventure Consulting, the team delves into the tumultuous world of the housing market, where Zillow's latest forecast sends shockwaves through the industry. With buyer demand plummeting and inventory soaring, cities across the nation are transforming into buyer's markets faster than a Bugatti Veyron on the Autobahn. Zillow's revised forecast of a mere 0.6% nationwide growth paints a grim picture compared to the initial 3% projection, leaving sellers scrambling to slash prices like a contestant on a high-stakes game show.

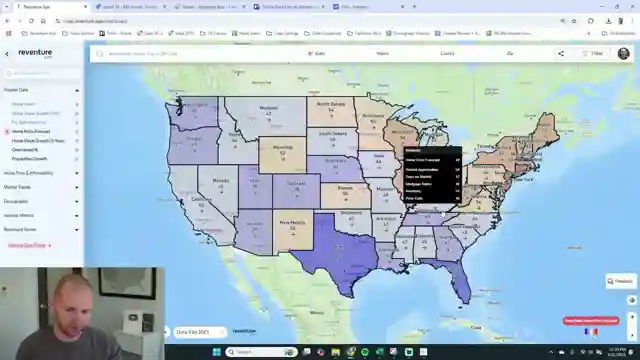

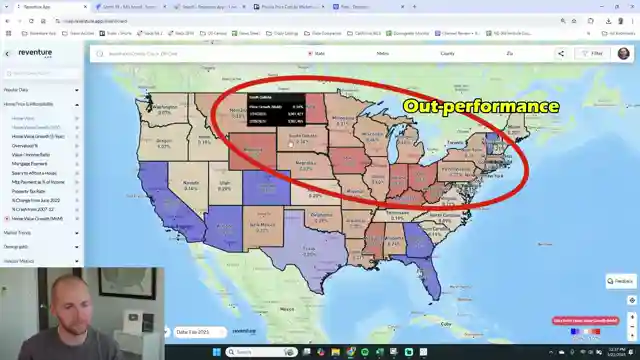

The housing market battlefield sees sellers engaging in a fierce price-cutting war, with statistics revealing the highest rate of price cuts in over a decade. States like Arizona, Florida, and Georgia witness sellers dancing on the edge of desperation, slashing prices left and right in a bid to attract elusive buyers. However, these price cuts may not be enough to entice wary buyers facing unprecedented affordability challenges in the midst of the largest housing bubble in history.

As the National Association of Realtors reports the worst February for home sales in 14 years, the housing market resembles a tense standoff between buyers and sellers. Despite the surge in listings and price reductions, sellers cling to inflated valuations, oblivious to the shifting tides of the market. The experts at Reventure Consulting analyze Zillow's recent home value figures, uncovering actual declines in states like California, Arizona, and Texas, signaling a turbulent journey ahead for the real estate sector.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Zillow officially cuts forecast. 242 cities heading for housing deflation. on Youtube

Viewer Reactions for Zillow officially cuts forecast. 242 cities heading for housing deflation.

Zillow has revised their 2025 U.S. price forecast down twice, now predicting price declines in over 240 cities

Reventure Consulting forecasts prices to drop in about 20 states over the next 12 months

Concerns about overpriced properties and the need for significant price cuts

Comments on the need for lower interest rates to save the market

Observations about specific housing markets like Florida, New York, and California

Criticisms of Zillow's forecasting and manipulation

Suggestions for significant price drops akin to 2008-2012 levels

Concerns about market manipulation and the need for context in interpreting housing market data

Speculations on the impact of housing crisis on financial markets and investments

Personal anecdotes about housing market experiences and observations

Related Articles

Florida Housing Market Crisis: Prices Plummet, Migration Declines

Reventure Consulting explores Florida's housing market crisis: prices drop 3.5-6%, migration down 80%, 182,000 homes for sale, forecasted 5.5% decline.

RV Market Crash: Economic Impact and Future Growth Prospects

The RV market in the US faces a significant downturn, with prices dropping by 25% and sales decreasing by half. This crash reflects broader economic challenges, impacting industries like housing and sport utility vehicles. Demographic shifts may drive future growth post-correction.

2025 US Housing Recession: State-by-State Analysis & Forecasts

Reventure Consulting reveals the 2025 US housing recession, with over half of states experiencing declines. High prices and low buyer demand drive the market correction, impacting various regions. Explore detailed forecasts on Reventure's app for valuable insights.

US Housing Market Shift: Declining Rents Impact Home Prices

Reventure Consulting's report reveals a significant decline in US rents, impacting home prices. Austin sees a 10% drop, signaling a shift in the real estate landscape. Investor activity and overvaluation rates are key factors to watch in navigating the evolving housing market.