Unveiling Cash Flow Realities in Real Estate Investment

- Authors

- Published on

- Published on

In the tumultuous world of real estate investing, the concept of cash flow is a topic of heated debate. While many influencers boast about their massive cash flow from rental properties, skeptics argue that it's all a sham. The team at BiggerPockets delves into this controversy, shedding light on the truth behind cash flow in the real estate realm. One key question arises: does a property truly cash flow before it's fully paid off? This query strikes a chord with many investors, including a community member named Mary, who grapples with properties that only partially cash flow.

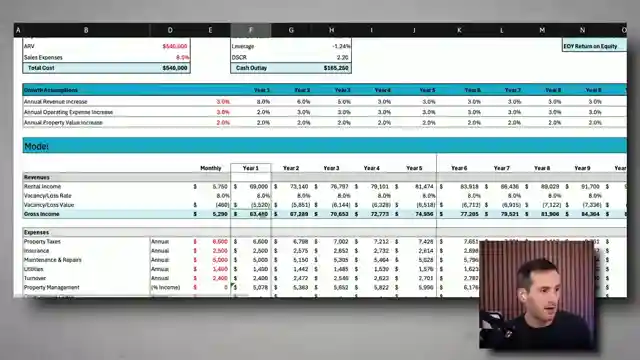

The crux of the matter lies in the definition of cash flow itself. Contrary to popular belief, cash flow is not simply the difference between rental income and basic expenses like mortgage and taxes. It encompasses a myriad of costs, including vacancies, repairs, and capital expenditures. By meticulously calculating all these expenses, investors can uncover the true cash flow potential of their properties. The channel emphasizes the importance of setting aside funds for future repairs, dispelling the myth that such costs should be considered part of the profit margin.

While some may expect immediate, robust cash flow from their investments, the reality often paints a different picture. Cash flow in real estate typically takes time to mature, gradually increasing as rents rise and expenses stabilize. The channel's expert, Dave, shares his personal journey of patiently waiting for cash flow to grow over 15 years. His experience serves as a testament to the long-term benefits of strategic real estate investing. By understanding the role of cash flow and adopting a patient approach, investors can unlock the full potential of their real estate ventures.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Is Real Estate “Cash Flow” a Sham? on Youtube

Viewer Reactions for Is Real Estate “Cash Flow” a Sham?

Accessing the spreadsheet

Investing in real estate vs. equities

Focusing on equity over cash flow

Cash flow projections vs. real cash flow

Importance of equity in deals

Debt impact on cash flow

Success with one property

Career in tech and building income base

Moving out of real estate

Personal investment strategies and experiences

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.