Unlocking Wealth: Investing in Medical Office Buildings

- Authors

- Published on

- Published on

In this exhilarating deep dive into the realm of commercial real estate investing, the team at Commercial Property Advisors shines a spotlight on the often overlooked yet immensely promising sector of Medical Office Buildings. Buckle up as they unveil five jaw-dropping reasons why these buildings are the hidden gems of the investment world. Picture this: long-term tenant stability, predictable cash flow, and massive tax benefits - all wrapped up in a package with far less competition than other real estate ventures. It's like finding a pot of gold at the end of a rainbow, but better.

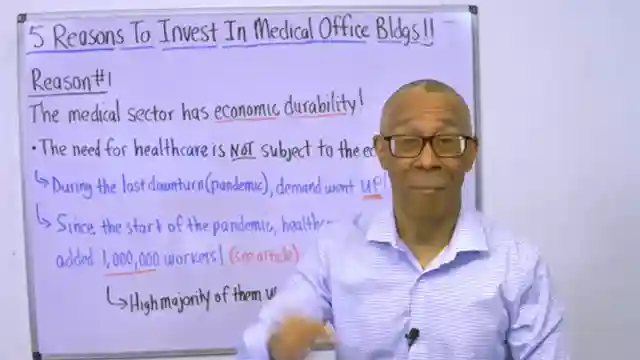

The first reason hits harder than a V8 engine roaring to life - the economic resilience of the medical sector. No matter the economic climate, the demand for healthcare services remains unwavering. From pandemic downturns to unprecedented growth, the need for medical facilities only skyrockets. And with a whopping 1 million employees added to the sector since the pandemic's onset, it's clear that Medical Office Buildings are the beating heart of stability in the real estate world.

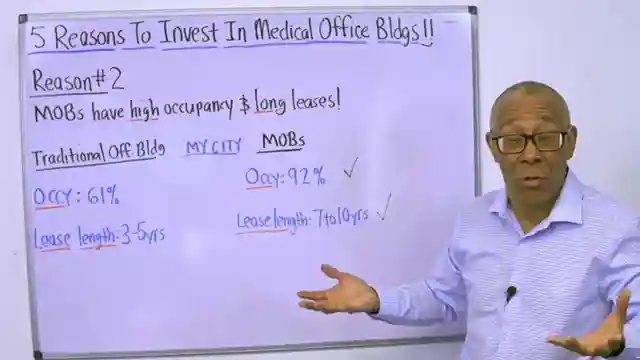

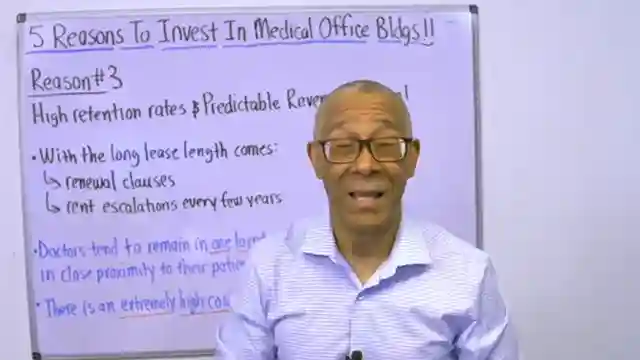

Moving on to reason number two, it's all about high occupancy rates and leases longer than a Shakespearean play. While traditional office buildings struggle with vacancies and short-term leases, Medical Office Buildings boast a staggering 92% occupancy rate and leases stretching between 7 to 10 years. It's like hitting the jackpot in a sea of uncertainty. And let's not forget about reason number three - the tantalizing cocktail of high retention rates and predictable revenue streams. Doctors staying put, rents going up - it's a real estate dream come true.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch 5 Reasons to Invest in Medical Office Buildings on Youtube

Viewer Reactions for 5 Reasons to Invest in Medical Office Buildings

Commercial real estate investors benefit from having a mentor

Positive comments about the content and expertise of the presenter

Interest in owning a MOB (Medical Office Building)

Request for more videos on investment criteria, analyzing, underwriting, and financing in the asset class

Related Articles

Mastering Multifamily Investments: Key Lessons for Success

Learn crucial multifamily property investment lessons from Commercial Property Advisors: prioritize cash flow and reserves, invest in top-notch property management, understand neighborhoods, start small, and take action over analysis paralysis for success in real estate.

Mastering Real Estate Funding: The 3 Essential Keys

Learn the three essential keys to effortlessly raising money for real estate deals from Commercial Property Advisors. Discover how to assess deal worthiness, position yourself attractively, and align opportunities with investor needs for successful funding.

Maximize Wealth: Why Choose Commercial Real Estate Over Stocks

Discover why Commercial Property Advisors recommends commercial real estate over stocks. Learn about predictability, cash flow, leverage, tax benefits, and building a lasting legacy through tangible assets. Gain control and stability in wealth-building today.

From Layoff to Real Estate Tycoon: Jaden's $14M Success Story

Follow Jaden's inspiring journey from corporate layoff to owning $14 million in multifamily properties. Learn how strategic investing and perseverance led to his success in commercial real estate.