Ultimate Guide to First Buy-to-Let Mortgages

- Authors

- Published on

- Published on

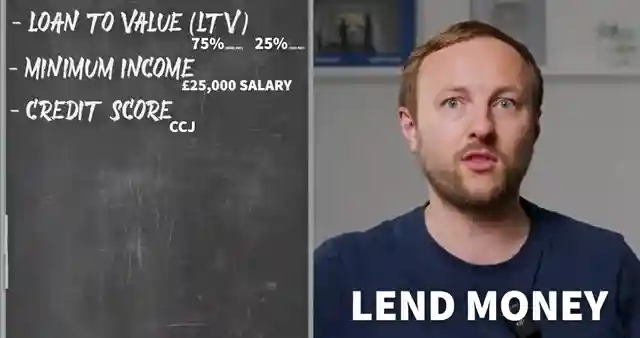

Welcome to Jamie York's guide on navigating the treacherous waters of securing your first buy-to-let mortgage. It's like embarking on a daring expedition, armed only with your financial prowess and determination. Jamie dives into the crucial factors that can make or break your mortgage dreams, from loan-to-value ratios to minimum income requirements. It's a high-stakes game where every percentage point and pound sterling counts.

One of the key battlegrounds in this mortgage saga is your credit score. It's like your financial report card, determining whether you're top of the class or barely scraping by. Jamie emphasizes the importance of maintaining a healthy credit history to unlock better rates and more lender options. And let's not forget about stress testing, where lenders scrutinize your rental income to ensure it can weather the storm of mortgage payments. It's a make-or-break moment that separates the rookies from the pros.

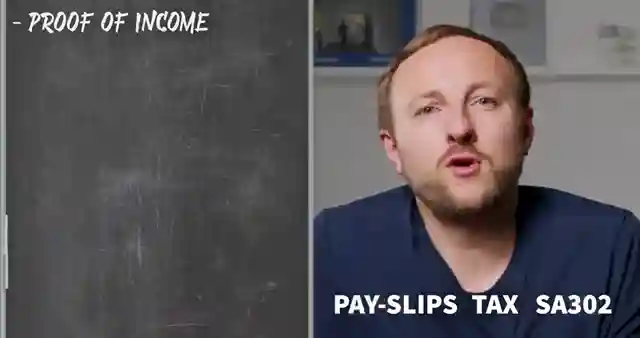

Armed with documents like proof of income, bank statements, and property details, you're ready to face the mortgage approval gauntlet. Jamie highlights the value of enlisting a mortgage broker or leveraging tools like Lendlord to navigate this complex terrain. Getting an agreement in principle signals to sellers that you're a serious player in the property game. But beware of common pitfalls like underestimating costs or applying for mortgages without expert guidance. It's a wild ride in the world of property investment, but with Jamie's guidance, you might just come out on top.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How to get your FIRST BUY-TO-LET MORTGAGE? on Youtube

Viewer Reactions for How to get your FIRST BUY-TO-LET MORTGAGE?

Request for a video on buying a first buy-to-let in a limited company

Positive feedback on the video

Interest in exploring Lendlord

Concern about increased stamp duty when buying a residential home after a BTL purchase

Inquiry about using equity to buy another house

Questions about surveys and landlord insurance policies

Mention of the term "bankster" and credit score impact

Related Articles

Unlock Property Investment Funds: Leveraging Home Equity with Jamie York

Learn how to access funds for property investment by leveraging your home equity through remortgaging. Jamie York's expert tips can help you kickstart your investment journey in just 8 weeks, without the need for significant savings or windfalls. Accelerate your wealth-building with smart debt utilization.

UK Property Market Insights: Seizing Investment Opportunities in 2025

Jamie York explores the UK property market, discussing US trade tariffs, prime London property resurgence, immigration's impact, and the supply-demand imbalance. Learn how to seize investment opportunities in 2025 with Aspire Portfolio's hands-free property portfolio building services.

Property Wealth Journey: Leveraging Assets in Yorkshire

Jamie York shares his journey to property riches, emphasizing leveraging debt and tangible assets like property. Focusing on Yorkshire for affordability and capital growth, he targets properties below the area's average price for steady financial gains.

2025 Property Forecast: Seize Opportunities with Stabilized Prices and Dropping Interest Rates

Jamie York's property forecast highlights the 2025 market window with stabilized prices and dropping interest rates. Learn how to leverage this opportunity, manage finances with Lendlord, and build a successful property portfolio. Take action now in the thriving rental market!