Ultimate Guide: Protect Trading Income with Wyoming LLCs & C Corporations

- Authors

- Published on

- Published on

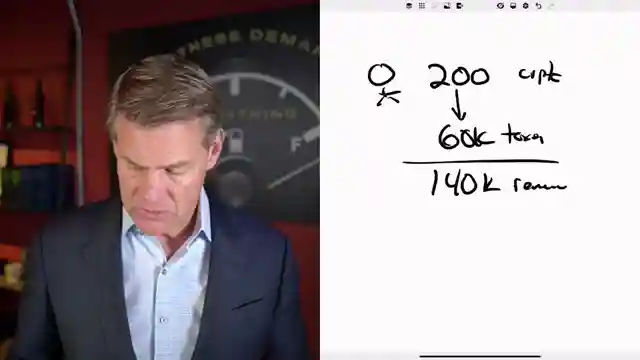

In this riveting episode, Clint Coons Esq. delivers a masterclass on safeguarding your trading ventures from the clutches of personal creditor claims. Picture this: you're a savvy investor raking in $200,000 from the volatile world of crypto trading. Now, here's the kicker - all that hard-earned cash is at the mercy of individual tax rates unless you armor up with the right entity structure. Enter the Wyoming LLC, your shield against financial predators, allowing you to slash taxable income by deducting those essential trading expenses. It's like having a bulletproof vest for your assets in the Wild West of trading.

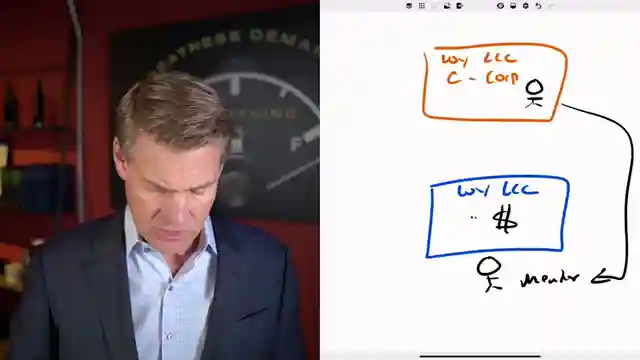

But wait, there's more. Clint unveils the pièce de résistance - the C corporation. This powerhouse entity swoops in with a flat 21% tax rate, swooshing away your worries about hefty tax bills. By strategically divvying up ownership between the LLC and the corporation, you can maneuver income streams, ensuring a chunk of that moolah lands in your pocket tax-free. It's a symphony of legal maneuvers orchestrated to perfection, painting a canvas where your hard-earned profits are shielded and optimized for maximum financial gain.

The magic doesn't stop there. Clint delves deeper into the nitty-gritty of structuring these entities to dance in harmony, ensuring your trading account is shielded from IRS scrutiny while maximizing tax benefits. It's a strategic tango between the LLC and the corporation, with each entity playing its part in the intricate tax-saving ballet. By harnessing the power of these entities, traders can navigate the treacherous waters of taxation with finesse, emerging victorious with more cash in hand and less lining Uncle Sam's pockets. So buckle up, traders, as Clint Coons Esq. takes you on a thrilling ride through the intricate world of asset protection and tax optimization.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch WHY TRADING AS A BUSINESS Is The BEST TAX HACK on Youtube

Viewer Reactions for WHY TRADING AS A BUSINESS Is The BEST TAX HACK

Positive feedback on the video

Concerns raised about a company not delivering legal work after being paid for it

Personal experience shared about dealing with taxes on crypto

Frustration expressed towards the tax system and regulations on crypto

Criticism of the inconsistency in categorizing crypto by different departments

Suggestion to offshore crypto for easier management and lower costs

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.