Ultimate Guide: Opening Bank Account for Anonymous LLC

- Authors

- Published on

- Published on

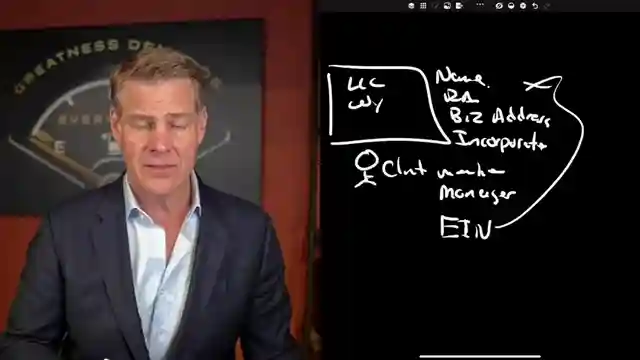

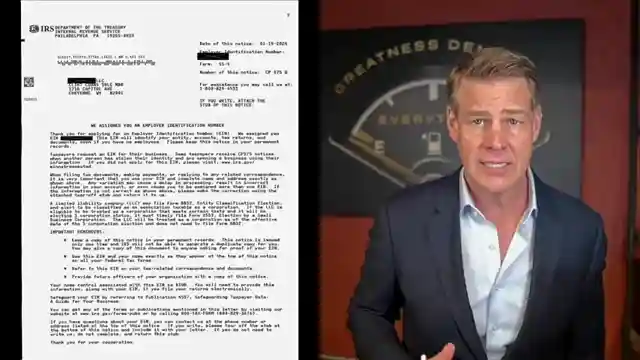

In this riveting episode, Clint Coons Esq. takes us on a thrilling journey into the world of setting up bank accounts for anonymous LLCs. Picture this: you want to open an account for your LLC without your name on it. Sounds impossible, right? Wrong! Clint reveals the secret weapon - obtaining an EIN from the IRS. This magical number is the key to proving ownership without revealing your identity. It's like a cloak of invisibility for your LLC in the banking world.

Now, let's talk Wyoming. This state offers the holy grail of anonymity for LLCs. When you register your LLC there, it's like stepping into a shadow realm where your name remains a mystery. But fear not! The EIN swoops in as your trusty sidekick, showcasing your ownership without blowing your cover. It's a genius move in the game of financial secrecy.

But wait, there's more! Clint drops another bombshell - the importance of having an operating agreement and banking resolution in your arsenal. These documents not only solidify your ownership but also add layers of protection to your LLC fortress. And when storming the bank to open your account, remember: keep it local. Using a local address simplifies the process and avoids unnecessary complications. So gear up, get that EIN, and conquer the banking world with your anonymous LLC like a true financial superhero!

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How to Open a Bank Account For Your Anonymous LLC (Easier Than You Think!) on Youtube

Viewer Reactions for How to Open a Bank Account For Your Anonymous LLC (Easier Than You Think!)

Request for information on who issues banking resolution and operating agreement documents for a single-member company

Discussion on routing numbers for business accounts and suggestion for customizable routing numbers like Huntington Bank

Seeking help with back taxes and suspicions of being filed as a dependent by ex-spouse and sister

Situation involving stolen online business and need for a tax attorney

Inquiry about recommendations for high-performing dividend stocks for investment

Request for advice on representing lottery winners to collect winnings, stay anonymous, and invest wisely

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.