Streamline Estate Planning: Transferring LLCs to Living Trusts

- Authors

- Published on

- Published on

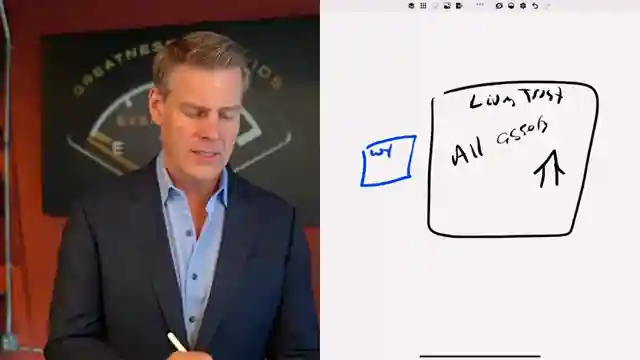

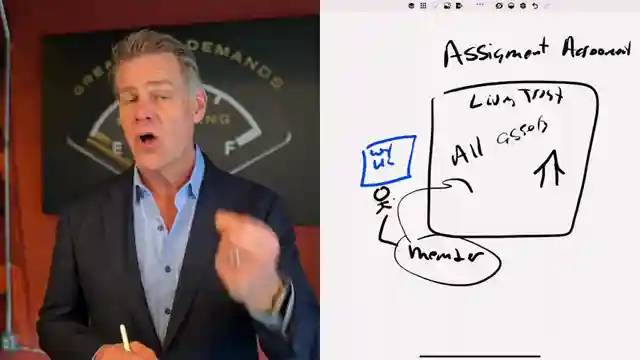

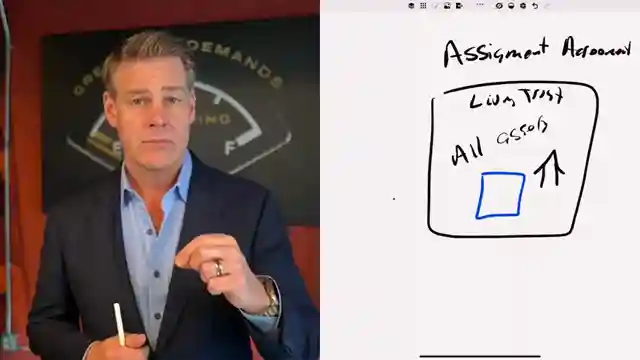

In this riveting episode, Clint Coons delves into the critical process of transferring LLCs into living trusts to sidestep the dreaded probate maze that awaits the unprepared. He highlights a common pitfall where individuals fail to align their LLCs with their living trusts, potentially leaving their estates vulnerable posthumously. By executing a straightforward assignment agreement, one can seamlessly shift ownership of LLCs to living trusts, ensuring a smooth transition to beneficiaries and evading the probate quagmire. Coons emphasizes the importance of reviewing and updating ownership documents to reflect living trust involvement for all LLCs, a crucial step in estate planning.

Coons dispels the misconception that updating operating agreements to indicate living trust ownership is necessary, cautioning against unnecessary complications with lenders. The impact on individual taxes from transferring LLC ownership to living trusts is clarified, reassuring viewers that grantor trusts remain inconsequential for federal tax purposes. As the trust becomes irrevocable posthumously, tax obligations shift accordingly. To aid viewers in this vital process, Coons generously provides a link to an assignment form for transferring LLC ownership to living trusts, facilitating a smoother estate planning journey for all.

In his signature no-nonsense style, Coons drives home the simplicity of this solution for those grappling with LLC ownership in the context of estate planning. By taking proactive steps to align LLCs with living trusts, individuals can safeguard their assets and streamline the transfer process for their loved ones. The episode serves as a wake-up call for viewers to review their ownership structures promptly and make the necessary adjustments to avoid potential probate headaches down the road.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How To Put LLCs Into A Living Trust (Transfer Assets!) on Youtube

Viewer Reactions for How To Put LLCs Into A Living Trust (Transfer Assets!)

Discussion about disregarded entity taxed holding company, trust, and LLC ownership

Mention of using Living Trust as Member in LLC

Planning to create a living trust soon

Concerns about asset protection against personal creditors with membership interest in a living trust

Question about using TOD/POD within the operating agreement to transfer membership upon death

Suggestion to just do a TOD

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.