Strategic Rental Property Transfer: LLC Tips by Clint Coons Esq.

- Authors

- Published on

- Published on

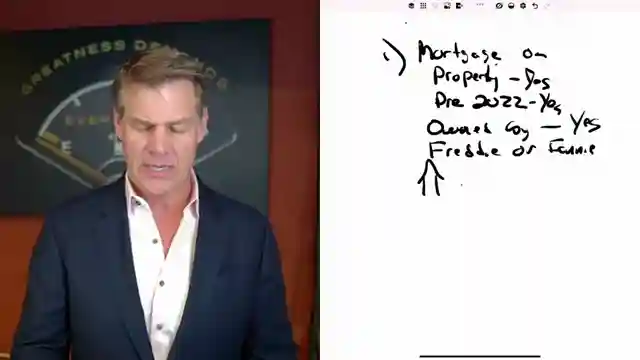

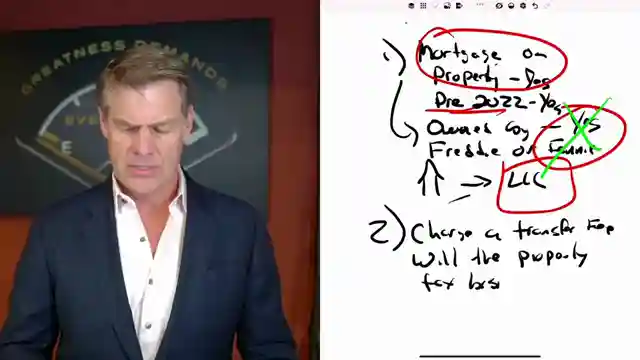

In this riveting episode, Clint Coons Esq. delves into the intricate process of transferring a rental property into a limited liability company (LLC). He emphatically warns against the careless use of a quitclaim deed, advocating instead for the meticulous utilization of a warranty deed to ensure airtight ownership protection. Coons stresses the importance of analyzing factors such as existing mortgages, ownership by entities like Freddie or Fannie, and potential transfer fees before making the leap into LLC territory. By setting up a land trust as a strategic intermediary step, viewers can navigate around acceleration clauses and tax complications with finesse.

The meticulous attention to detail advocated by Coons is a refreshing departure from the oversimplified advice often touted by ill-informed sources. By emphasizing the significance of proper planning and thorough analysis, he underscores the complexities involved in safeguarding one's real estate assets. Coons' strategic approach of transferring property into a land trust before integrating it with an LLC showcases his expertise in asset protection strategies. His recommendation to seek professional guidance for a seamless transition reflects a commitment to ensuring viewers embark on this journey armed with knowledge and foresight.

With a no-nonsense attitude and a wealth of experience, Coons challenges conventional wisdom surrounding LLC transfers, debunking myths propagated by uninformed sources. By shedding light on the potential pitfalls of hasty decisions and advocating for a methodical approach, he empowers viewers to make informed choices in safeguarding their investments. Coons' blend of expertise and practical advice serves as a beacon of guidance in a landscape fraught with misconceptions and half-truths.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How To Move Rental Property Into An LLC (DO THIS FIRST) on Youtube

Viewer Reactions for How To Move Rental Property Into An LLC (DO THIS FIRST)

Thanking the creator for the content

Advice on transferring mortgage to an LLC

Investing $385K in dividend stocks for high returns

Seeking recommendations for strong dividend stocks

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.