Scott Trench: Bearish Outlook & Investment Opportunities for 2025

- Authors

- Published on

- Published on

Today on the BiggerPockets podcast, Scott Trench steps in for Dave to deliver a no-holds-barred take on the investment landscape of 2025. With a bold bearish stance, Scott dives into the concept of irrational exuberance 3.0, warning of overvalued assets and the potential pitfalls lurking across various sectors. From cash to Bitcoin, he dissects the major asset classes available to the average American, shedding light on his personal portfolio reallocations amidst the current economic climate.

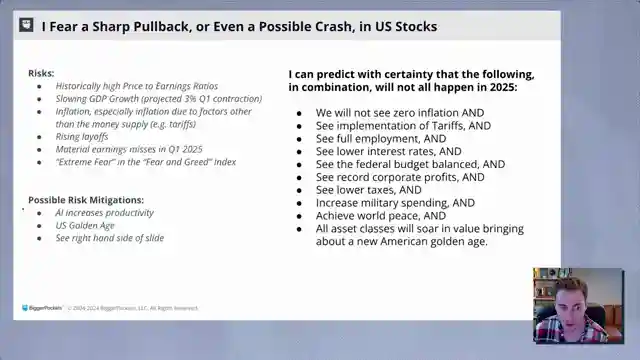

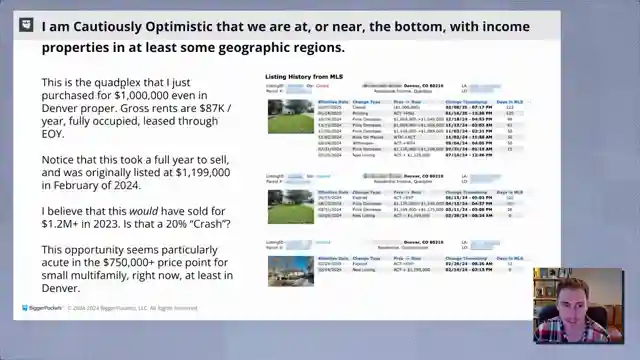

Scott pulls no punches as he predicts stubbornly high interest rates and foresees a looming crash in US stocks, citing alarming price-to-earnings ratios and sluggish GDP growth as red flags. His insights into the residential and commercial real estate markets reveal potential buying opportunities amidst price corrections and valuation losses. With a keen eye on inflation and the money supply's impact on asset prices, Scott challenges the prevailing narrative of indiscriminate index fund investments, urging listeners to tread cautiously in the volatile financial landscape of 2025.

In his signature no-nonsense style, Scott Trench paints a stark picture of the investment terrain, cautioning against blind optimism and advocating for a strategic, informed approach to portfolio management. With a blend of data-driven analysis and gut instinct, he navigates the murky waters of market uncertainty, offering a refreshing perspective on wealth-building strategies in the face of economic turbulence. Buckle up, folks, because in Scott's world, it's not just about making money—it's about making smart, calculated moves to stay ahead of the game in an ever-evolving financial arena.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Scott Trench: How I'm Protecting My Money From “Irrational Exuberance” on Youtube

Viewer Reactions for Scott Trench: How I'm Protecting My Money From “Irrational Exuberance”

Request for more similar content

Positive feedback on analysis

Interesting analogy of hermit crabs exchanging shells

Suggestion to improve visibility of labels and legend in presentation

Discussion on stock market crash impact on FIRE individuals and investment strategies

Speculation on market growth due to government spending

Inquiry on breaking into real estate industry with an app

Speculation on home prices and interest rates

Critique on PE ratios and index funds

Consideration of Federal Reserve's balance sheet for inflation tracking

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.