Protecting LLC Assets: Expert Tips for Safeguarding Business Wealth

- Authors

- Published on

- Published on

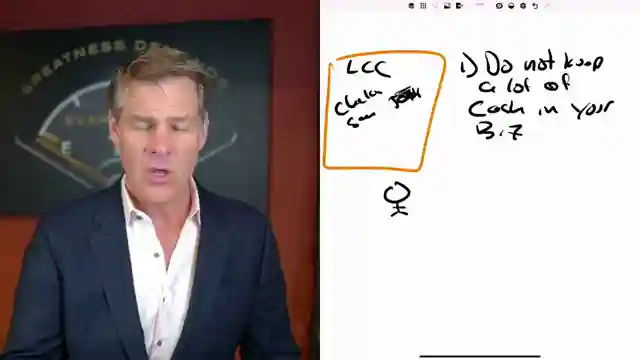

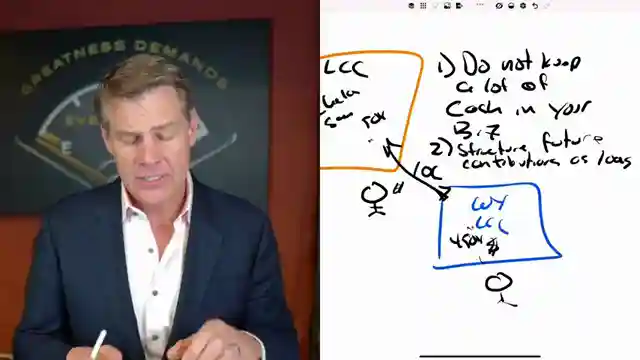

In this riveting episode, Clint Coons Esq. fearlessly delves into the treacherous waters of protecting LLCs from the clutches of creditors. He passionately advocates for a strategic approach to safeguarding assets, urging viewers to steer clear of hoarding cash within their businesses. By deftly transferring excess funds to a secure Wyoming LLC, Coons champions a proactive stance against potential lawsuits that could spell financial ruin. His advice is as bold and uncompromising as a roaring engine on the open road.

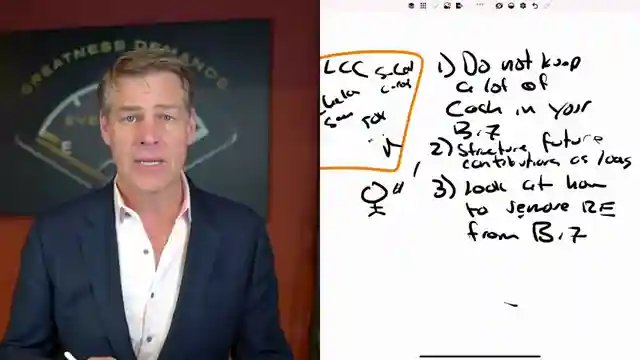

Furthermore, Coons emphasizes the importance of structuring future contributions as loans and strategically removing real estate holdings from the business entity. With the precision of a seasoned race car driver navigating a treacherous track, he guides viewers through the intricate maneuvers required to shield their hard-earned wealth from the looming threat of creditor attacks. The stakes are high, but Coons' expertise shines through as a beacon of hope in the murky waters of asset protection.

Moreover, Coons unveils a brilliant strategy involving the separation of high-value equipment into a distinct entity, shielding these crucial assets from the reach of potential creditors. His advice is a symphony of calculated risk and strategic foresight, resonating with the spirit of adventure that drives entrepreneurs to push beyond the limits of convention. With each word, Coons paints a vivid picture of a battlefield where knowledge is the ultimate weapon against the forces of financial adversity.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch If You're Worried Your LLC is Exposed to Creditors...DO THIS on Youtube

Viewer Reactions for If You're Worried Your LLC is Exposed to Creditors...DO THIS

How to prepare for incoming wealth

Success story with Coach Melanie Ann Karnavas

Question about LLC ownership structure

Investing $385K in dividend stocks for 30% annual returns

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.