Protect Real Estate Assets: Importance of Separate LLCs for Property Management

- Authors

- Published on

- Published on

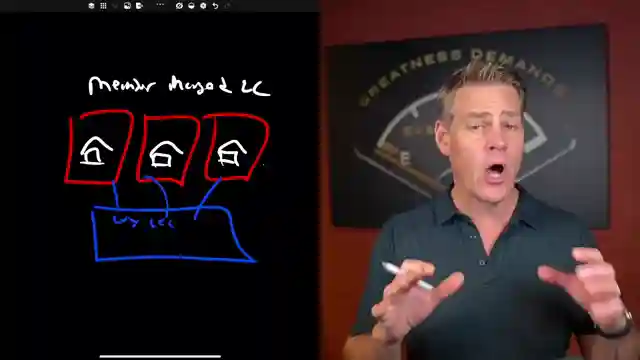

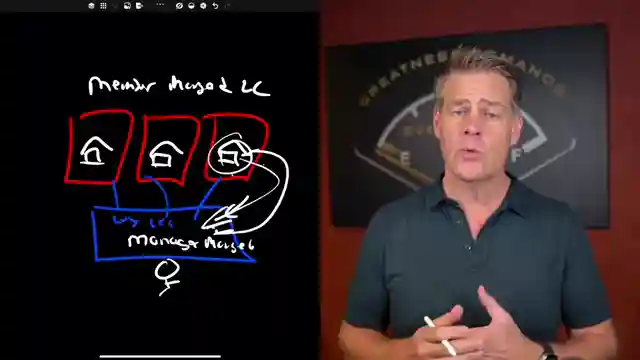

In this riveting episode by Clint Coons Esq., he delves into the intricate world of real estate asset protection with the finesse of a seasoned pro. He unveils the common blunder many investors make by managing properties under their own name, even within an LLC, leaving them perilously exposed to legal threats. Clint advocates for a strategic approach, emphasizing the necessity of a separate LLC for property management to fortify one's assets against potential lawsuits. With a dynamic structure involving property LLCs across states and a protective Wyoming LLC at the helm, Clint showcases the blueprint for robust asset safeguarding.

The crux of Clint's argument lies in the distinction between managing an LLC and managing the property itself, a nuance that could mean the difference between financial security and ruin. By elucidating the pitfalls of tenants paying the LLC directly, Clint underscores the importance of a dedicated management entity to shield the entire asset structure from legal vulnerabilities. Through his expert guidance, viewers are urged to steer clear of using the holding company as the property manager, a misstep that could jeopardize the very assets it aims to protect.

As the episode unfolds, Clint's passion for empowering viewers to navigate the complex realm of asset protection shines through. Encouraging active engagement and questions from his audience, Clint not only imparts invaluable knowledge but also fosters a community of informed investors poised to safeguard their portfolios effectively. With a blend of expertise, foresight, and a touch of charisma, Clint Coons Esq. emerges as a beacon of guidance in the realm of real estate asset protection, offering viewers a pathway to financial resilience and peace of mind.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Holding LLC Structure Mistakes That Could Cost You Everything on Youtube

Viewer Reactions for Holding LLC Structure Mistakes That Could Cost You Everything

Inquiry about LLC structures and consultations

Concerns about property management and LLC ownership

Questions about tax structures for investment properties

Methods of transferring funds between LLC and personal accounts

Updates on BOI reporting

Clarifications on LLC management and protection

Setting up a Wyoming LLC for real estate investments

Handling payments and bank accounts for LLCs

Average return on investments

Confusion and questions regarding the structure and protection of properties within LLCs

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.