Property Investment Funding Guide: Mortgages, Bridging, JV, Private Financing

- Authors

- Published on

- Published on

In this riveting video by Jamie York, he delves into the thrilling world of property investment funding. Starting off with the adrenaline-pumping buy-to-let mortgages, Jamie explains how a 25% deposit can unlock the door to a heart-racing 75% debt financing, leading to exhilarating capital growth benefits and rock-bottom interest rates. But hold on to your seats, folks, as Jamie then takes us on a wild ride through the world of bridging finance, a short-term solution that promises lightning-fast turnaround times and unmatched flexibility, albeit at a cost of 1% per month.

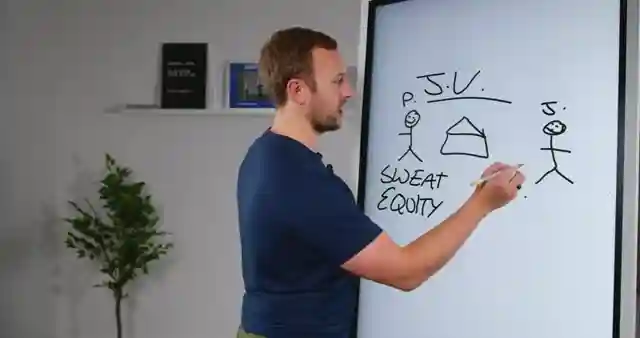

But the excitement doesn't end there! Jamie introduces us to the adrenaline-fueled world of joint ventures, where individuals like Pete and Jamie join forces, with one providing the cash and the other bringing in the sweat equity, resulting in a heart-pounding profit-sharing adventure upon property sale. And just when you thought it couldn't get any more thrilling, Jamie throws us into the high-octane realm of private financing, where individuals similar to him come together for a turbocharged funding experience, often in the form of straight loans, ensuring a pulse-pounding journey through the world of property investment. So buckle up, folks, as Jamie York takes us on a wild, action-packed ride through the adrenaline-fueled world of property investment funding!

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch PROPERTY FINANCE - Made EASY! on Youtube

Viewer Reactions for PROPERTY FINANCE - Made EASY!

Worth listening to while driving to work

Need solutions for accessing finance to scale property investments

Looking for a property sourcer to find a deal

Concern about using equity in property as a deposit or security

Mention of The House Crowd going into administration

Question about the difference in criteria between 20% and 25% LTV buy-to-let mortgages

Concern about properties not increasing in value

Dilemma between cash flow and putting minimum deposits on properties

Interest in education on property investment

Mention of APG

Related Articles

Unlock Property Investment Funds: Leveraging Home Equity with Jamie York

Learn how to access funds for property investment by leveraging your home equity through remortgaging. Jamie York's expert tips can help you kickstart your investment journey in just 8 weeks, without the need for significant savings or windfalls. Accelerate your wealth-building with smart debt utilization.

UK Property Market Insights: Seizing Investment Opportunities in 2025

Jamie York explores the UK property market, discussing US trade tariffs, prime London property resurgence, immigration's impact, and the supply-demand imbalance. Learn how to seize investment opportunities in 2025 with Aspire Portfolio's hands-free property portfolio building services.

Property Wealth Journey: Leveraging Assets in Yorkshire

Jamie York shares his journey to property riches, emphasizing leveraging debt and tangible assets like property. Focusing on Yorkshire for affordability and capital growth, he targets properties below the area's average price for steady financial gains.

2025 Property Forecast: Seize Opportunities with Stabilized Prices and Dropping Interest Rates

Jamie York's property forecast highlights the 2025 market window with stabilized prices and dropping interest rates. Learn how to leverage this opportunity, manage finances with Lendlord, and build a successful property portfolio. Take action now in the thriving rental market!