Property Cash Flow Showdown: Kingston vs. Wonga

- Authors

- Published on

- Published on

In this thrilling episode, the team delves into the adrenaline-pumping world of increasing cash flow, from a heart-stopping $122,000 to a mere $271 a year in the red. The battle royale unfolds between a property featuring a Granny flat and a block of units, with the enigmatic Gilbert Melgar, a maestro of property investment, data analysis, and the founder of Suburbs Finder, providing his expert insights on this high-octane cash flow showdown.

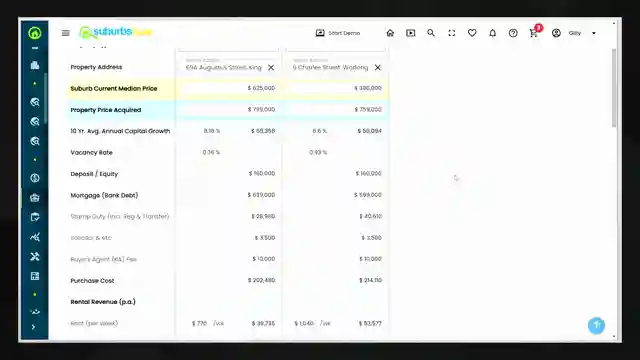

The first contender hails from the sun-soaked lands of Kingston, Queensland, boasting a duplex where the main house commands a rent of $420 while unit 2 follows closely at $350, culminating in a total rental income of $770. This property, priced at $799, offers a modest 5% yield, with Kingston showcasing an impressive 8% annual growth over the past decade. Meanwhile, the Logan Council emerges as a key player with major infrastructure projects like the Logan Hospital expansion and the M1 Pacific Highway North upgrade, setting the stage for a fierce cash flow battle.

On the other side of the ring stands the formidable opponent from Wonga, Regional Victoria, a block of four units where the combined rental income hits a staggering $960, yielding a robust 6.51%. With a potential rental uplift to $1,040 on the horizon, the yield skyrockets to a jaw-dropping 7.05%, making Wonga a force to be reckoned with. Wonga's landscape is painted with the promise of growth, courtesy of a half-billion-dollar hospital project and a population of 20,000, soaring to 200,000 when Albury joins the fray.

As the dust settles on this epic clash, the cash flow comparison reveals Kingston languishing at a gloomy -$12,574 per year, while Wonga stands tall at a mere -$271 annually. Wonga emerges victorious, not only for its superior cash flow but also for its untapped growth potential through strategic strata titling. This exhilarating showdown underscores the critical importance of meticulous comparison and analysis in navigating the treacherous waters of property investment, ensuring that every move brings you closer to your financial goals.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Granny flat vs. Unit Block, what's got better Cashflow? - With Gilbert Melgar on Youtube

Viewer Reactions for Granny flat vs. Unit Block, what's got better Cashflow? - With Gilbert Melgar

Clarification on how to properly say decimal numbers

Discussion on pronunciation of numbers

Related Articles

From Bee Farmer to Millionaire: The Inspiring Journey of Bill Childs

Discover the inspiring journey of Bill Childs, a Gen Z bee farmer turned property investor who built a $5.4 million portfolio through hard work and resilience despite personal tragedies and deceitful family members. Gain insights into his path to success and the importance of perseverance in achieving financial goals.

When to Sell Your Stagnant Property: Paramata Insights

Explore when to sell a property in Paramata, New South Wales, amid stagnant growth. Insights from Investigate Jungar reveal market trends and suggest selling as a viable option. Stay informed and make wise property decisions with Pizza and Property Podcast.

Mastering Property Deals: Building Inspection Tips by Miles Clark

Learn how building inspector and entrepreneur Miles Clark reveals the secrets of negotiating better property deals through understanding building inspection reports. Discover modern repair technologies and the importance of accurate cost estimates in real estate transactions.

Unveiling Melton: Property Market Insights

Explore Melton's property market potential with insights on new infrastructure, diverse communities, and growth projections. Uncover good pockets, transportation impacts, and investment opportunities in this dynamic suburb.