Navigating Uncertain Times: Real Estate Investing in the "Upside Era

- Authors

- Published on

- Published on

In a tumultuous financial landscape where tariffs play peekaboo and the stock market resembles a rollercoaster, BiggerPockets steps in with a revamped investment strategy for the current era. Dubbed the "upside era," this approach marries economic data analysis with real-world experience to navigate the shifting sands of the market. The team sheds light on the resilience of real estate investing, highlighting its role as a beacon of financial freedom and wealth creation amidst uncertainty. Drawing from the turbulent first quarter of 2025, they showcase investment deals tailored to thrive in this dynamic environment, urging investors to seize the opportunities presented.

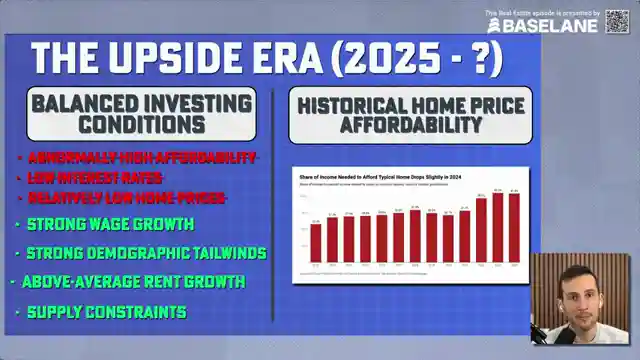

Comparing the present to the "Goldilocks era," characterized by a harmonious blend of affordability, low interest rates, and demographic trends, the podcast underscores the enduring appeal of real estate as an investment powerhouse. While some factors have undergone metamorphosis, such as affordability and interest rates, pillars like wage growth, demographic tailwinds, and supply constraints continue to favor real estate enthusiasts. The narrative unfolds into a compelling case for real estate's resilience in the face of economic flux, encouraging investors to adapt and capitalize on the evolving landscape.

Venturing into the realm of alternative investments, the podcast dissects the allure of real estate against the backdrop of cryptocurrency, stocks, bonds, and private businesses. Real estate emerges as a multifaceted gem, offering return diversity through appreciation, cash flow, loan amortization, and tax perks. Its income potential shines bright, with cash on cash returns eclipsing other investment avenues and paving the way for sustainable wealth accumulation. With leverage opportunities, inflation protection, and the tangibility of assets, real estate stands tall as a formidable contender in the quest for long-term financial prosperity.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch The Real Estate Strategy with HUGE Upside Even During Downturns on Youtube

Viewer Reactions for The Real Estate Strategy with HUGE Upside Even During Downturns

Being a landlord can be a nightmare, especially during the Covid epidemic

Factors affecting being a landlord: maintenance and repair, cost of homeowner insurance, property tax, regional job market, and cost of living

Difficulty in obtaining start-up capital for buying investment property

Positive feedback on fix and flip as a starting point for real estate investment

Disagreement with opinions shared

Criticism towards the current POTUS and his use of tariffs

Appreciation for the overview provided in the video

Mention of house hacking as a strategy

Encouragement and excitement from viewers to engage with the content

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.