Navigating the Turbulent Real Estate Market: Insights from Ken McElroy

- Authors

- Published on

- Published on

In this riveting episode by Ken McElroy, the harsh reality of the housing market's current state is laid bare. Homeownership, once a beacon of the American dream, now seems like a distant fantasy as prices soar to unprecedented heights. The culprit? Affordability, or rather, the lack thereof. With high housing prices, interest rates, and operational costs looming over buyers, investors, and renters like a dark cloud, the future looks bleak. But fear not, for in the midst of this chaos, a glimmer of hope emerges as McElroy delves into the heart of the issue.

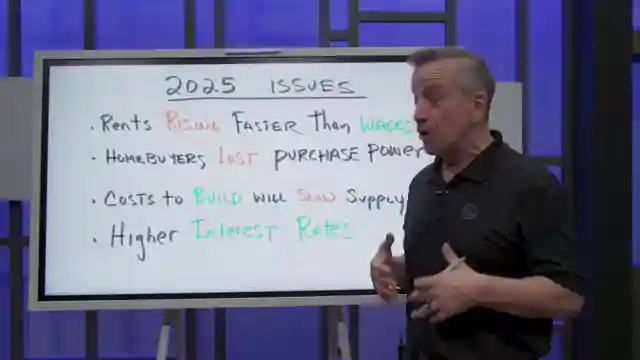

From the perspective of tenants facing imminent rent hikes to employees struggling with stagnant wage growth, the challenges are manifold. Builders, too, find themselves in a bind as rising land and construction costs threaten to derail their plans. And let's not forget the landlords, grappling with escalating operational expenses that eat into their profits. It's a perfect storm brewing in the real estate market, with no signs of abating anytime soon.

As McElroy peels back the layers of this complex problem, he offers insights into potential solutions. By focusing on increasing housing supply through strategic investments and regulatory reforms, there may yet be a light at the end of the tunnel. The key lies in understanding the dynamics of the market, identifying opportunities in states with favorable conditions, and staying ahead of the curve. In a world where affordability is the name of the game, those who can adapt and innovate will emerge victorious in the ever-evolving landscape of real estate.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Why Buying a Home Is Harder Than Ever Before on Youtube

Viewer Reactions for Why Buying a Home Is Harder Than Ever Before

Concerns about the housing market, including rising prices, mortgage rates, and inventory issues

Speculation on the potential for a housing crisis and the impact on buying and investing

Discussion on the impact of inflation, interest rates, and government policies on the housing market

Criticism of real estate agents and commissions

Diversification into stocks as an alternative investment strategy

Views on the affordability of housing and the challenges faced by first-time buyers

Mention of the Turkish real estate market as a potential investment opportunity

Comments on the historical context of housing prices and inflation

Critiques of the current housing market structure and suggestions for reform

Concerns about the impact of high property taxes and insurance costs on homeownership

Related Articles

Navigating Economic Uncertainties: Insights from Ken McElroy

Ken McElroy discusses the economy's dire state, the impact of national debt, and the importance of tangible assets like gold and Bitcoin for financial stability. Attendees are urged to gain insights at the upcoming Limitless event for navigating economic uncertainties.

Ken McElroy: Board Games for Financial Success & Investing Insights

Ken McElroy advocates using board games to teach practical skills like real estate and sales for financial success. He warns against investing in bonds, promotes hard assets, and discusses the impact of automation on job markets. Join the Limitless event for expert insights!

The Truth About Rising Homeownership Costs: A Market Analysis

Ken McElroy exposes the hidden costs of homeownership surpassing $18,000 yearly before mortgages. Rising expenses, supply shortages, and high demand are reshaping the housing market, pushing many towards renting. Policy changes may offer relief, but for now, owning a home remains a luxury.

Ken McElroy Explains Why $1 Detroit Homes Were Not Worth It

Ken McElroy shares insights on why he passed on $1 homes in Detroit due to hidden costs, neighborhood issues, and the importance of focusing on fundamentals in real estate investing.