Navigating the Global Financial Landscape: Impact of the Strengthening US Dollar

- Authors

- Published on

- Published on

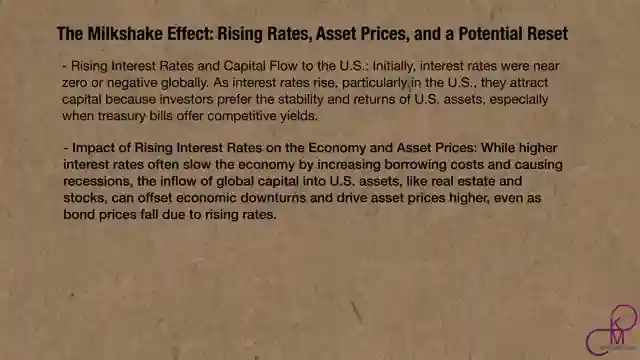

The dollar is on a rampage, flexing its muscles as global economies struggle and the US stands tall. With its tax haven status and allure for investors worldwide, the US is the place to be. But as the dollar strengthens, the rest of the world feels the squeeze. Countries owe debts in dollars, not just to the US, making it harder for them to keep up when their currencies weaken. The DXY hitting a 13-year high spells trouble for global economies, as a strong dollar means trouble for others.

In this high-stakes financial tango, the dollar's dominance is a double-edged sword. While some believe printing money weakens the dollar, the reality is far more nuanced. The US can export its inflation woes, leaving other countries drowning in economic turmoil. The greenback's demand outside the US keeps it afloat, unlike other currencies. This global game of fiat versus fiat has real consequences, with every financial crisis shaped by these dynamics.

As capital flows into the US, asset prices soar, attracting foreign investors like moths to a flame. The dollar's strength not only impacts economies but also real estate markets worldwide. Interest rate fluctuations further complicate matters, influencing the ebb and flow of capital. The US dollar's role as the global currency is a powerful force, dictating transactions and debts among nations. When economic engines stall, debts come knocking, leading to a credit crunch that reverberates across borders.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch A Global Currency Crisis Has Begun, Here's What It Means For You on Youtube

Viewer Reactions for A Global Currency Crisis Has Begun, Here's What It Means For You

Concerns about the current state and future of the U.S. dollar

Impact of inflation on the value of the dollar and alternative options for safeguarding wealth

Views on the U.S. economy, debt, and global power dynamics

Criticisms and skepticism towards the U.S. financial system and policies

Discussion on the role of gold, fiat currency, and global trade

Comments on the rule of law and investment in the U.S.

Speculation on the future of the U.S. economy and potential financial crises

Views on the impact of U.S. leadership and global economic realignment

Critiques of U.S. economic policies and global influence

Suggestions for diversifying portfolios and preparing for economic uncertainties

Related Articles

Navigating Economic Uncertainties: Insights from Ken McElroy

Ken McElroy discusses the economy's dire state, the impact of national debt, and the importance of tangible assets like gold and Bitcoin for financial stability. Attendees are urged to gain insights at the upcoming Limitless event for navigating economic uncertainties.

Ken McElroy: Board Games for Financial Success & Investing Insights

Ken McElroy advocates using board games to teach practical skills like real estate and sales for financial success. He warns against investing in bonds, promotes hard assets, and discusses the impact of automation on job markets. Join the Limitless event for expert insights!

The Truth About Rising Homeownership Costs: A Market Analysis

Ken McElroy exposes the hidden costs of homeownership surpassing $18,000 yearly before mortgages. Rising expenses, supply shortages, and high demand are reshaping the housing market, pushing many towards renting. Policy changes may offer relief, but for now, owning a home remains a luxury.

Ken McElroy Explains Why $1 Detroit Homes Were Not Worth It

Ken McElroy shares insights on why he passed on $1 homes in Detroit due to hidden costs, neighborhood issues, and the importance of focusing on fundamentals in real estate investing.