Navigating Real Estate Shifts: Mortgage Rates Drop & Inventory Rises

- Authors

- Published on

- Published on

In this episode of BiggerPockets, they dive headfirst into the tumultuous world of real estate amidst dropping mortgage rates and surging inventory. Dave Meyer, the maestro of real estate investing, dissects the current landscape in three riveting parts. First up, the thrilling saga of mortgage rates hitting rock bottom and inventory levels soaring, paving the way for a buyer's market. The delicate dance between supply and demand, as indicated by active listings and days on market, sets the stage for a market teetering on the edge of change.

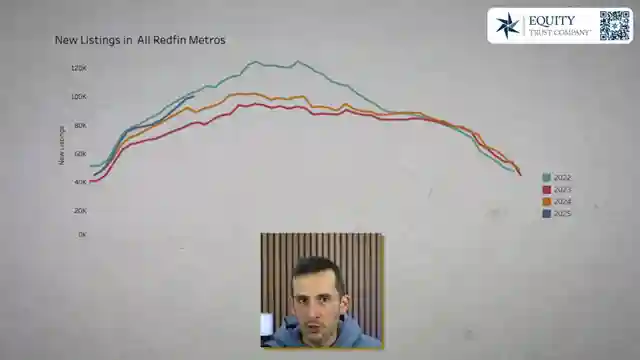

The adrenaline rush continues as Meyer unravels the mystery behind rising inventory, attributing it to a surge in property listings rather than dwindling demand. New listings skyrocket by 13% year-over-year, injecting a dose of excitement into the market dynamics. Despite the frenzy, buyer demand remains steadfast, with mortgage applications on the rise, fueled by the allure of lower rates. Sales prices, a beacon of hope in the chaos, show a modest increase of 2.5-3.5% year-over-year, a glimmer of stability in an otherwise turbulent market.

As the plot thickens, the looming specter of tariffs and stock market upheavals casts a shadow over the real estate realm. Meyer delves into the psychological impact of stock market volatility on home buyer demand, a rollercoaster of emotions and uncertainties. The stage is set for a high-octane showdown between economic indicators and market forces, with inflation and buyer sentiment hanging in the balance. BiggerPockets leaves viewers on the edge of their seats, eagerly anticipating the next twist in the thrilling saga of real estate in the face of adversity.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Home Prices to Weaken as Inventory Piles Up (April 2025 Update) on Youtube

Viewer Reactions for Home Prices to Weaken as Inventory Piles Up (April 2025 Update)

Investing in different sources of income not dependent on the government is crucial during the current economic crisis

Consider investing in stocks like gold, silver, and digital currencies

Stock market has experienced a lot of volatility since April 8

Interest in more in-depth information on investing in Florida for short or midterm

Question about the delay in video uploads

Considering selling a property with renters leaving soon

Mention of emotions and stages in investing such as greed, delusion, fear, capitulation, and despair

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.