Maximizing Real Estate Profits: Trump 2025 Tax Cuts Guide

- Authors

- Published on

- Published on

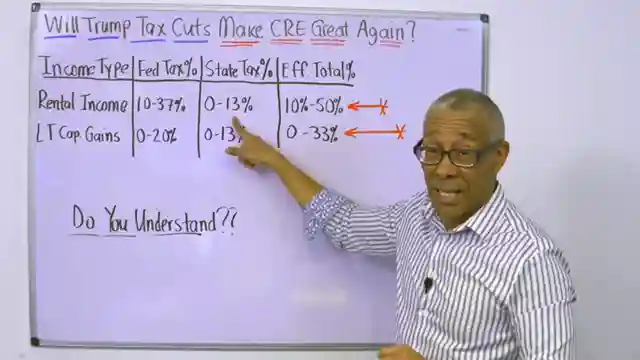

In the latest episode of Commercial Property Advisors, the team takes on the colossal topic of the proposed Trump 2025 tax cuts, set to be the biggest in US history. With the swagger of a seasoned real estate investor, they dissect the potential impact of these cuts from the perspective of cash flow, long-term growth, and capital preservation. It's all about navigating the complex world of taxes in commercial real estate investing, with a focus on understanding income taxes and their significant role in shaping profits. The stage is set for a showdown of epic proportions as they gear up to break down the top three proposed tax cuts that could revolutionize the game for investors.

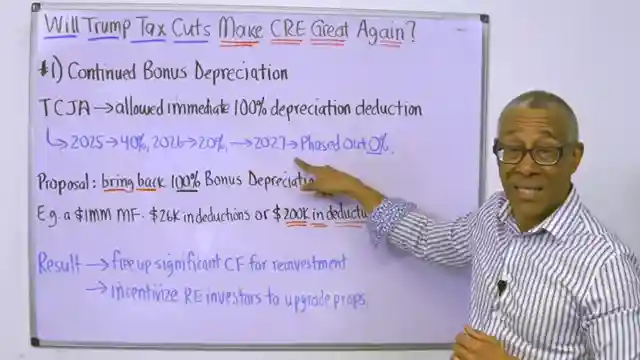

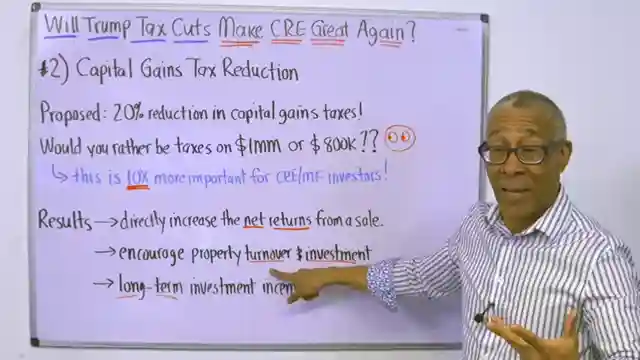

First up on the chopping block is the return of 100% bonus depreciation, a magic pill that could work wonders for property owners by boosting cash flow and fueling property improvements. This proposed cut aims to unleash a wave of reinvestment opportunities, giving investors the firepower to upgrade their properties and drive growth. Next in line is a tantalizing 20% reduction in capital gains taxes, a move that could turbocharge net returns and ignite a frenzy of buying and selling in the real estate market. The potential ripple effects of this cut could spell a new era of profitability and activity for commercial and multifamily investors.

But the real cherry on top comes in the form of the extension of the pass-through deduction, a lifeline for small to medium commercial and multifamily owners looking to slash taxable income and pocket more cash. This proposed cut promises to put more money in the pockets of everyday Americans, making real estate investments more tax-efficient and appealing. With these three proposed tax cuts in the pipeline, the future of commercial real estate investing looks brighter than ever. So buckle up, folks, and get ready to ride the wave of greatness that these cuts could bring to the world of real estate investment.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Will Trump Tax Cuts Make Commercial Real Estate Great Again? on Youtube

Viewer Reactions for Will Trump Tax Cuts Make Commercial Real Estate Great Again?

Appreciation for guidance on financial success through investments, spending, and budgeting

Mention of making Bibi great again

Concern about tax cuts not getting approved

Related Articles

Mastering Multifamily Investments: Key Lessons for Success

Learn crucial multifamily property investment lessons from Commercial Property Advisors: prioritize cash flow and reserves, invest in top-notch property management, understand neighborhoods, start small, and take action over analysis paralysis for success in real estate.

Mastering Real Estate Funding: The 3 Essential Keys

Learn the three essential keys to effortlessly raising money for real estate deals from Commercial Property Advisors. Discover how to assess deal worthiness, position yourself attractively, and align opportunities with investor needs for successful funding.

Maximize Wealth: Why Choose Commercial Real Estate Over Stocks

Discover why Commercial Property Advisors recommends commercial real estate over stocks. Learn about predictability, cash flow, leverage, tax benefits, and building a lasting legacy through tangible assets. Gain control and stability in wealth-building today.

From Layoff to Real Estate Tycoon: Jaden's $14M Success Story

Follow Jaden's inspiring journey from corporate layoff to owning $14 million in multifamily properties. Learn how strategic investing and perseverance led to his success in commercial real estate.