Maximize Net Worth: Rent Out Your Home & Boost Finances

- Authors

- Published on

- Published on

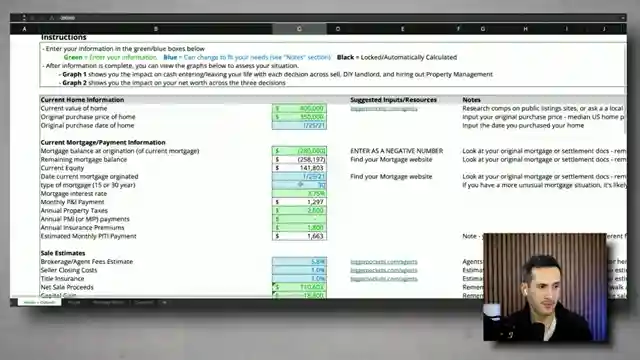

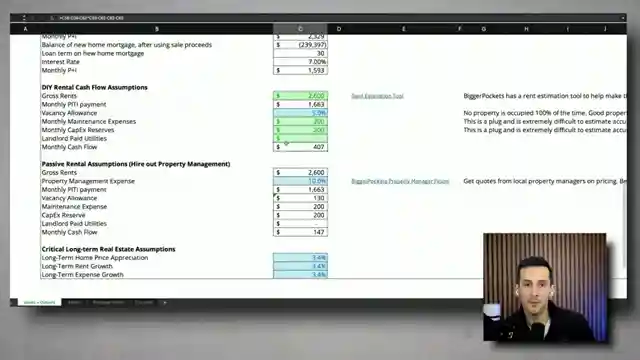

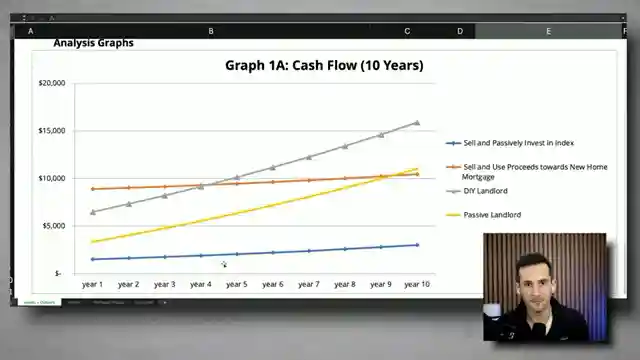

In this riveting BiggerPockets video, the team delves into the intriguing concept of renting out your home instead of selling it. A move that could potentially skyrocket your financial standing by a whopping $300,000 over a decade. The discussion revolves around crucial factors like current mortgage payments, potential rental income, and overall cash flow, all while considering future housing plans. They provide a nifty calculator to help you navigate through these complex variables and determine if transforming into a landlord is the right path for you.

The video meticulously lays out various scenarios, from selling the property and investing in index funds to using the proceeds for a new home, or taking on the role of a self-managing or professional landlord. Through a detailed analysis of cash flow and net worth implications over time, it becomes evident that holding onto the property as a DIY landlord emerges as the most financially rewarding decision in the long haul. The video underscores the significance of comprehending the financial ramifications of renting out a property and offers a practical tool to facilitate informed decision-making.

With a touch of flair and a dash of financial wisdom, BiggerPockets navigates viewers through the intricate world of real estate investment. By presenting real-life examples and tangible calculations, they empower individuals to make informed choices that could potentially revolutionize their financial future. So, buckle up, grab your calculators, and get ready to embark on a thrilling journey of financial discovery with BiggerPockets.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch Should I Sell or Rent My House in 2025? ($300,000 Difference) on Youtube

Viewer Reactions for Should I Sell or Rent My House in 2025? ($300,000 Difference)

User shares their experience of becoming a landlord due to job relocation

Comment about the typical cost of selling a property being around 10%

Request for a forecast on home values and rents for the next 5 years

Difficulty in finding the rent vs sell calculator on the website

Comparison of returns in real estate investing versus SP500 index fund

Question about whether it's a good decision to rent out a paid-off home and buy a new one

Mention of various tools available but inability to find the rent vs sell calculator on the website

Related Articles

From Rocket Science to Real Estate Success: The Co-Living Strategy

Former nuclear rocket scientist Miller Mwain achieved financial independence through real estate investing with a co-living strategy, turning 6 properties into 41 units for high cash flow. His story highlights the power of creativity and strategic thinking in building a successful investment portfolio.

Mastering Rental Property Acquisition: BiggerPockets Strategies

Learn how to acquire five rental properties in five years with BiggerPockets' expert strategies: house hacking and the Burr method. Achieve financial freedom through savvy real estate investments.

The Hidden Benefits of Real Estate Investing: Beyond Financial Gains

Join BiggerPockets as Dave Meyer and Chad Carson explore the hidden benefits of real estate investing beyond money. Discover the power of intentional, small-scale investing for a fulfilling life alongside financial success.

Maximizing Real Estate Returns: Short vs. Long-Term Strategies

Explore profitable real estate investments with BiggerPockets, analyzing short-term and long-term rental strategies in Texas and Oregon. Learn how to maximize revenue and navigate market challenges for financial success.