Mastering Multifamily Investing: Top Tips for Success

- Authors

- Published on

- Published on

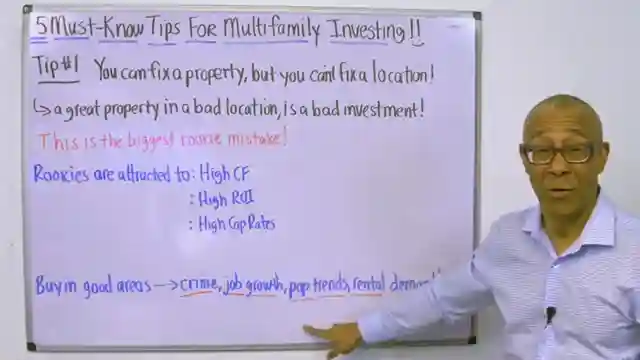

In this riveting episode by Commercial Property Advisors, we delve into the exhilarating world of multifamily investing. Buckle up, because we're about to uncover five top-tier tips that will separate the men from the boys in this high-octane game of real estate. First up, the importance of location, location, location! It's not just about the property; it's about where that property stands. Crime rates, job growth, population trends, and rental demand are the key ingredients to a successful investment. Don't be fooled by flashy numbers on paper; a bad location can sink your ship faster than you can say "cash flow."

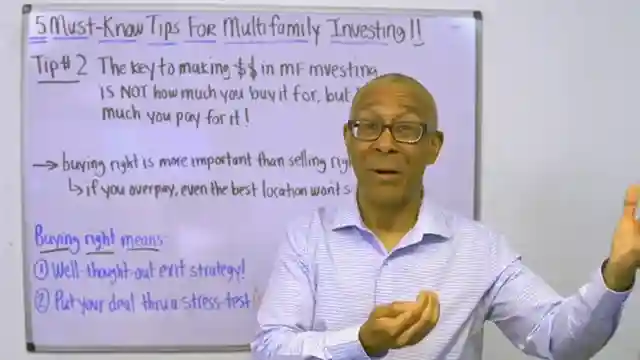

Next, we shift gears to the art of buying right over selling right. It's not about how much you buy a property for, but how much you pay for it. Have a clear exit strategy in mind from the get-go and stress-test your deals to ensure they can weather any storm. Remember, it's a long game in the world of multifamily investing, so buckle down and plan for the long haul. Moving on to tip number three, we explore the thrilling concept of passive income. The key to financial success lies in accumulating income-producing assets. Don't wait for the perfect moment to buy real estate; instead, buy now and let the income follow.

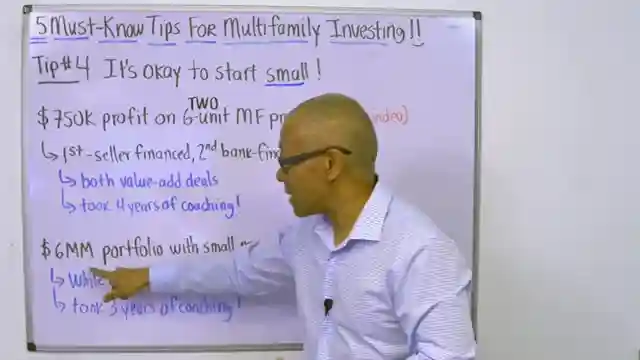

Now, let's talk about starting small. Yes, you heard that right. It's perfectly acceptable to dip your toes in the multifamily investing pool with smaller properties. Take it from the success stories of students who turned modest investments into substantial profits through value-add strategies. Remember, Rome wasn't built in a day, and neither will your multifamily empire. Lastly, we unveil the crown jewel of real estate investing: cost segregation and bonus depreciation. These powerful tax strategies can turbocharge your property's depreciation, slashing your taxable income to potentially zero. Combine a cost segregation study with bonus depreciation for maximum tax benefits and accelerated wealth-building. So, rev up your engines and dive into the adrenaline-fueled world of multifamily investing with these five game-changing tips from Commercial Property Advisors.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch 5 Must Know Tips for Multifamily Investing on Youtube

Viewer Reactions for 5 Must Know Tips for Multifamily Investing

Mentoring is important for successful commercial real estate investors

Some viewers enjoy the presenter's presentations

Counting how many times the presenter says "ok" is a point of interest

Discussion about the investment potential of a multi-family property with Section 8 tenants in a C class area

Importance of purchasing below value in real estate investments

Related Articles

Mastering Multifamily Investments: Key Lessons for Success

Learn crucial multifamily property investment lessons from Commercial Property Advisors: prioritize cash flow and reserves, invest in top-notch property management, understand neighborhoods, start small, and take action over analysis paralysis for success in real estate.

Mastering Real Estate Funding: The 3 Essential Keys

Learn the three essential keys to effortlessly raising money for real estate deals from Commercial Property Advisors. Discover how to assess deal worthiness, position yourself attractively, and align opportunities with investor needs for successful funding.

Maximize Wealth: Why Choose Commercial Real Estate Over Stocks

Discover why Commercial Property Advisors recommends commercial real estate over stocks. Learn about predictability, cash flow, leverage, tax benefits, and building a lasting legacy through tangible assets. Gain control and stability in wealth-building today.

From Layoff to Real Estate Tycoon: Jaden's $14M Success Story

Follow Jaden's inspiring journey from corporate layoff to owning $14 million in multifamily properties. Learn how strategic investing and perseverance led to his success in commercial real estate.