Mastering Money Management: From Paycheck Survival to Passive Income

- Authors

- Published on

- Published on

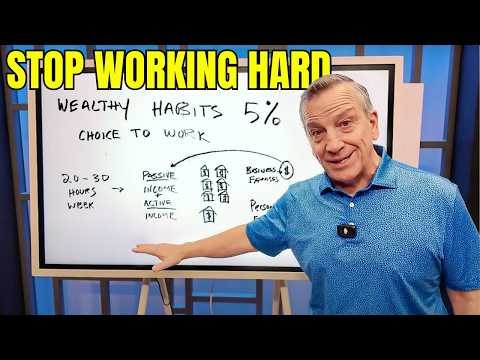

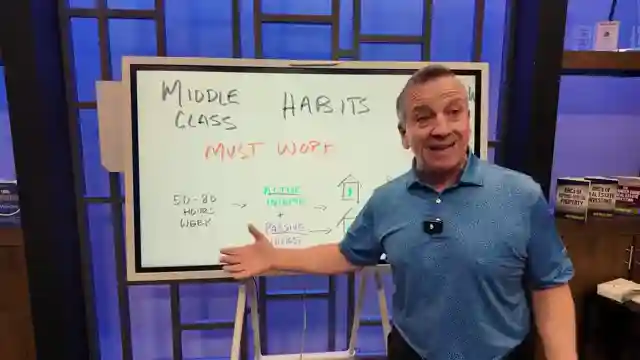

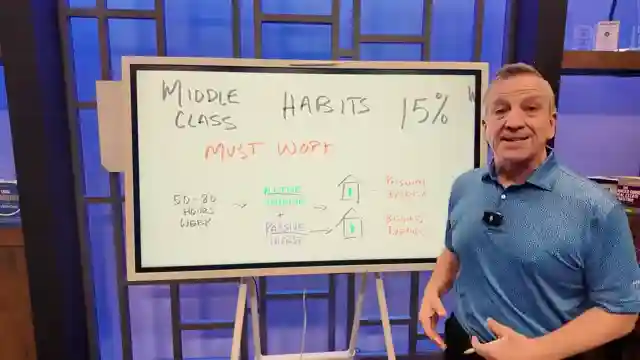

In this riveting video from Ken McElroy, he delves into the intricate world of money management, unveiling the three distinct levels that individuals navigate on their path to financial success. Starting with paycheck survival, many find themselves trapped in a cycle of trading time for money to cover basic expenses like rent and food. Transitioning to middle-class habits involves working tirelessly to increase active income and venturing into passive income investments such as stocks and gold. The pivotal moment arises when one opens a business bank account, allowing for the legal allocation of business expenses and the creation of multiple income streams.

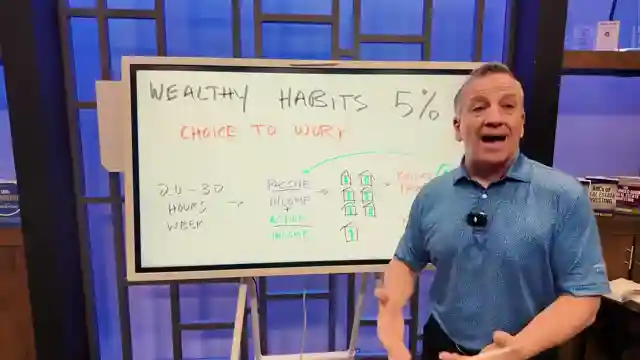

As the journey progresses, individuals learn from the wealthy who have mastered the art of focusing solely on passive income, granting them the freedom to work fewer hours and enjoy financial independence. With diverse income sources ranging from real estate to stocks and retirement plans, the wealthy actively manage their investments and leverage tax strategies to safeguard their wealth. Unlike the poor and middle class who often rely on financial planners, the wealthy take a hands-on approach, ensuring their financial stability through meticulous planning and diversification.

By adopting similar strategies and cultivating multiple income streams, individuals can emulate the path to financial freedom and wealth accumulation laid out by Ken McElroy. Through proactive investment management and a keen eye for lucrative opportunities, anyone can break free from the shackles of financial constraints and pave the way towards a prosperous future. Ken McElroy's insightful breakdown serves as a beacon of hope for those seeking to transcend the limitations of paycheck survival and ascend to the realm of true financial success.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How the Rich Work LESS and Make MORE (While You Stay Stuck) on Youtube

Viewer Reactions for How the Rich Work LESS and Make MORE (While You Stay Stuck)

Splitting pay between savings, spending, and investments

Importance of self-education for financial success

Building wealth through good habits and investments

Real estate as a game-changer for wealth building

Success stories of significant financial gains

The power of diversifying income streams

Realization that working longer hours may not lead to success

Different perspectives on wealth accumulation and business ownership

The impact of books on financial knowledge and mindset

Advice on investing money rather than keeping it in a bank

Related Articles

Navigating Economic Uncertainties: Insights from Ken McElroy

Ken McElroy discusses the economy's dire state, the impact of national debt, and the importance of tangible assets like gold and Bitcoin for financial stability. Attendees are urged to gain insights at the upcoming Limitless event for navigating economic uncertainties.

Ken McElroy: Board Games for Financial Success & Investing Insights

Ken McElroy advocates using board games to teach practical skills like real estate and sales for financial success. He warns against investing in bonds, promotes hard assets, and discusses the impact of automation on job markets. Join the Limitless event for expert insights!

The Truth About Rising Homeownership Costs: A Market Analysis

Ken McElroy exposes the hidden costs of homeownership surpassing $18,000 yearly before mortgages. Rising expenses, supply shortages, and high demand are reshaping the housing market, pushing many towards renting. Policy changes may offer relief, but for now, owning a home remains a luxury.

Ken McElroy Explains Why $1 Detroit Homes Were Not Worth It

Ken McElroy shares insights on why he passed on $1 homes in Detroit due to hidden costs, neighborhood issues, and the importance of focusing on fundamentals in real estate investing.