Master LLC Tax Strategies: C Corp, S Corp, Partnership & Disregarded Entity Explained

- Authors

- Published on

- Published on

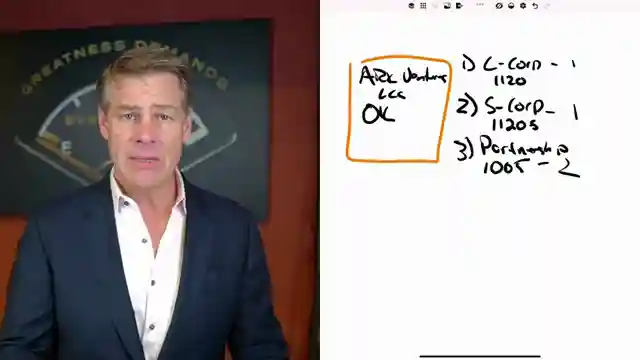

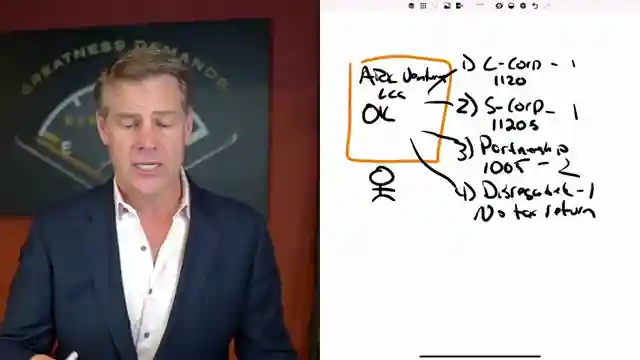

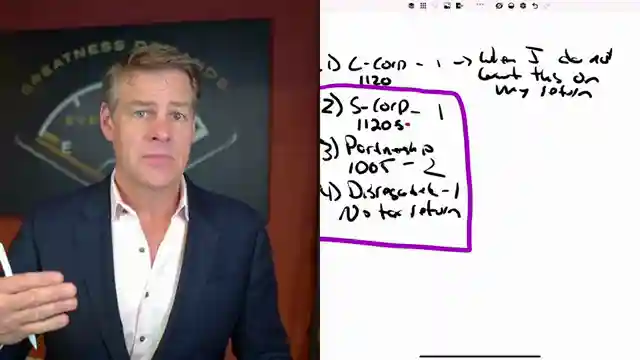

In this riveting video from Clint Coons Esq., the man himself breaks down the thrilling world of LLC taxation options with the finesse of a seasoned race car driver navigating a treacherous track. He delves into the heart-pounding choices available for LLC owners, from the roaring power of a C Corporation to the nimble agility of an S Corporation, each offering a unique blend of tax advantages and filing requirements. Clint emphasizes the critical importance of aligning your operating agreement with your chosen tax status to avoid a fiery crash with the IRS during audits.

For those looking to keep their business activities off their personal tax returns or revving up their reinvestment game, the roaring engine of a C Corporation might be the turbocharged choice. On the other hand, the sleek curves of an S Corporation offer a turbo boost in saving on employment taxes, making it a thrilling ride for small business owners seeking to maximize their earnings. And let's not forget the partnership or disregarded entity options, perfect for those cruising through the scenic route of passive income activities like rental real estate, ensuring a smooth and flexible journey without any unexpected roadblocks.

Clint's expert guidance steers viewers through the winding roads of LLC taxation, cautioning against treacherous pitfalls when dealing with appreciated assets or borrowed funds within the business structure. The adrenaline-inducing blend of tax strategies and asset protection tips offered in this video is akin to a high-octane race, where every decision counts towards the ultimate victory of financial success. So buckle up, hit the accelerator, and join Clint Coons Esq. on this thrilling ride through the fast and furious world of LLC tax planning.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch How To Tax Your LLC (What You Need To Consider!) on Youtube

Viewer Reactions for How To Tax Your LLC (What You Need To Consider!)

Positive feedback on the content

Request for setting up a call

Appreciation for the creator's content

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.