Ken McElroy: Navigating Real Estate Shifts and Emerging Markets

- Authors

- Published on

- Published on

In this riveting episode, Ken McElroy delves into the tumultuous world of real estate markets, revealing a seismic shift that has left traditional investors reeling. With soaring operating costs, stagnant rents, and a regulatory landscape akin to a raging inferno, major players are fleeing to greener pastures. The stage is set for a showdown of epic proportions as the smart money migrates to burgeoning markets where demand is high, and affordability reigns supreme.

McElroy underscores the pivotal role of people and money in the real estate arena, emphasizing the critical factors that drive individuals and businesses to new frontiers. From exorbitant housing costs to concerns over safety and access to talent, the motivations behind these mass migrations are as diverse as they are compelling. Drawing from his own eye-opening experience in Detroit, McElroy paints a vivid picture of the catastrophic consequences that ensue when jobs vanish, crime soars, and communities wither away.

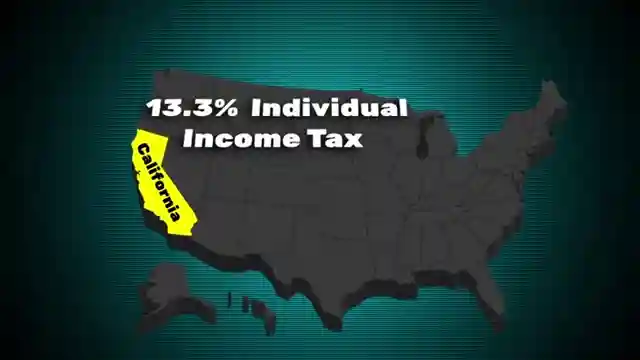

As the exodus from high-tax coastal states gains momentum, employers are seeking refuge in areas that offer a more hospitable climate for business growth. From the siren call of zero corporate taxes in Wyoming to the punishing levies of California, the financial landscape plays a pivotal role in shaping the real estate terrain. McElroy's astute observations shed light on the intricate dance between regulatory burdens, economic incentives, and the fundamental human desire for a better quality of life.

In a rallying cry to aspiring investors, McElroy champions a balanced approach to landlord-tenant laws, advocating for a level playing field that benefits both parties. By steering clear of pro-tenant states and embracing environments that foster fairness and accountability, investors can navigate the choppy waters of real estate with confidence. As the winds of change sweep across the nation, McElroy's insights serve as a beacon of hope for those seeking to make savvy investment decisions in an ever-evolving market landscape.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch If You Own Real Estate Here, Get Out Now (The Market Has Changed) on Youtube

Viewer Reactions for If You Own Real Estate Here, Get Out Now (The Market Has Changed)

Investing in states with growing job markets and reasonable cost of living

Real estate market trends in Los Angeles, San Diego, Gary Indiana, and Texas

Concerns about pro-tenant laws in Colorado

Impact of high costs of living on companies in California

Huntsville, Alabama's high per capita ratio of engineers and scientists

Recommendations for investing in dividend stocks

Skepticism about moving to areas prone to natural disasters

Discord trading success story

Humorous comment about $1 homes being overpriced

Offer for YouTube SEO optimization services

Related Articles

Navigating Economic Uncertainties: Insights from Ken McElroy

Ken McElroy discusses the economy's dire state, the impact of national debt, and the importance of tangible assets like gold and Bitcoin for financial stability. Attendees are urged to gain insights at the upcoming Limitless event for navigating economic uncertainties.

Ken McElroy: Board Games for Financial Success & Investing Insights

Ken McElroy advocates using board games to teach practical skills like real estate and sales for financial success. He warns against investing in bonds, promotes hard assets, and discusses the impact of automation on job markets. Join the Limitless event for expert insights!

The Truth About Rising Homeownership Costs: A Market Analysis

Ken McElroy exposes the hidden costs of homeownership surpassing $18,000 yearly before mortgages. Rising expenses, supply shortages, and high demand are reshaping the housing market, pushing many towards renting. Policy changes may offer relief, but for now, owning a home remains a luxury.

Ken McElroy Explains Why $1 Detroit Homes Were Not Worth It

Ken McElroy shares insights on why he passed on $1 homes in Detroit due to hidden costs, neighborhood issues, and the importance of focusing on fundamentals in real estate investing.