Asset Protection Strategies for Uninsured Real Estate Investments

- Authors

- Published on

- Published on

In this riveting episode, Clint Coons Esq. delves into the treacherous world of asset protection for uninsured real estate investments. Picture this: a client facing a lawsuit over an uninsured property in a single LLC. It's a recipe for disaster, a ticking time bomb waiting to explode. When insurance becomes a distant dream due to exorbitant premiums or property risks, you need a game plan, a strategy to shield your assets from the storm.

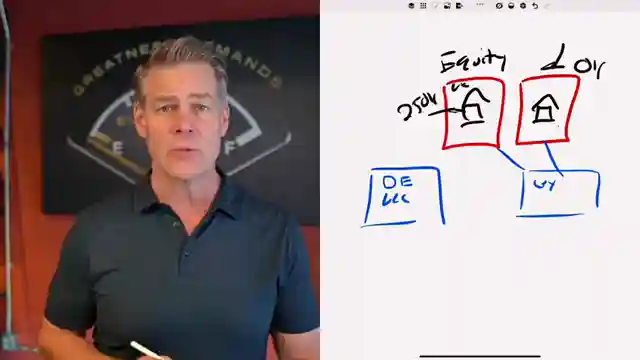

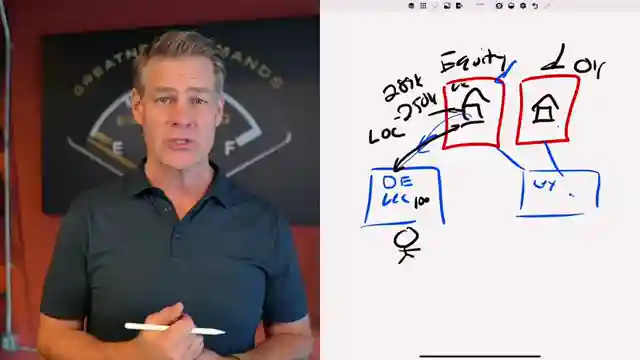

To combat this looming threat, Clint advocates for a bold move: separate each property into its own entity, be it an LLC or a land trust. This divide and conquer approach minimizes the risk exposure of your assets, ensuring that a legal battle on one front doesn't jeopardize the entire battalion. But what about safeguarding the equity locked within these uninsured properties? That's where the plot thickens, where the real drama unfolds.

Enter the hero of our story: the Delaware LLC. A mysterious entity shrouded in anonymity, ready to swoop in and protect your equity like a knight in shining armor. By orchestrating a complex dance of loans and collateral, Clint unveils a masterful strategy to confuse and outmaneuver potential creditors. It's a high-stakes game of chess, where every move must be calculated with precision to emerge victorious in the face of adversity. So buckle up, hold on tight, and prepare to witness the art of asset protection like never before.

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Image copyright Youtube

Watch No Insurance? Here's How To Protect Your Real Estate Assets on Youtube

Viewer Reactions for No Insurance? Here's How To Protect Your Real Estate Assets

Investors considering lawsuit and LLC strategy

Concerns about monthly payments between LLCs

Transferring USDT from OKX wallet to Binance

Suggestion to buy a liability-only policy

Researching creditor's attorney and deed of trust

Considering using a New Mexico LLC for equity asset stripping

Seeking stock recommendations for dividend investing

Discussion on using Delaware LLC vs New Mexico LLC

Questions about charging order protection

Seeking advice on proxy hiring for LLC operations

Related Articles

Maximizing Tax Benefits: LLC Strategies for Real Estate Investors

Learn how setting up LLCs can optimize tax benefits for real estate investors. Passive investors preserve depreciation, while active investors reduce tax liabilities through strategic tax elections. Anderson Advisors offer free strategy sessions for tailored business structures and tax optimization, including out-of-state entity considerations.

Maximizing LLC Profits: Tax-Efficient Strategies for Real Estate Income

Learn how to pay yourself from your LLC without raising taxes. Clint Coons Esq. explains strategies for passive and active income, from distributions to reimbursements, ensuring tax efficiency in real estate ventures.

Mastering Out-of-State Property Flipping: Expert Tips with Wyoming LLCs

Learn how Clint Coons Esq. advises on structuring out-of-state property flipping for asset protection and tax efficiency using Wyoming LLCs. Simplify your real estate investments with expert strategies.

Master LLC Naming: Anonymity, Branding, and Asset Protection

Clint Coons advises on LLC naming strategies, emphasizing business-oriented, concise names to ensure anonymity, minimize risks, and streamline operations. He cautions against using personal names and shares insights on using DBAs for effective branding. Prioritizing asset protection, Clint highlights the importance of prompt entity setup for financial security.